New Jersey is another in a growing list of states to learn that imposing renewable portfolio standards (RPS) on electrical utilities raises prices on ratepayers and harms the state’s economy, costing thousands of jobs and millions of dollars in investment while robbing citizens of over a billion dollars in disposable income.

A new study projects that by 2021, New Jersey’s RPS will:

- Increase electricity prices by nearly 11 percent

- Increase the cost of electricity on consumers by $1.05 billion

- Increase the average electricity bill of households by $95 per year

- Increase the average electricity bill of commercial businesses by $985 per year

- Increase the average electricity bill of industrial businesses by $8,745 per year

Gratuitously increasing the price of electricity — which is no luxury good, but a basic necessity for households and businesses — on everyone will have serious ramifications throughout the economy, the study found. By 2021 those are projected to include:

- Loss of 11,365 jobs

- Loss of $199 million in investment in the state

- Loss of $1.4 billion in real disposable income

The study, produced by economists at the Beacon Hill Institute at Suffolk University, explained what is at stake in New Jersey and, by extension, any other RPS state, including North Carolina (emphasis added):

Lost among the claims of increased investment and jobs in the "green" energy sector is a discussion of the opportunity costs of RPS polices. By mandating that electricity be produced by more expensive sources, ratepayers in the state will experience higher electricity prices. This means that every business and manufacturer in the state will have higher costs, leading to less investment in both capital and labor. Moreover, every household will have less money to spend on other purchases, such as groceries and entertainment.

Proponents of the RPS law are correct: there will be more investment and jobs in the "green" energy sector, but rarely do they mention the loss of jobs and investment in every other sector in the state.

That explanation cuts straight to the heart of the matter. Advocates for RPS mandates, state incentives for nondispatchable ("green") energy, or any other kind of cronyism in favor of green energy, invariably avoid the most important issue: what electricity costs to consumers at the flip of the switch.

Instead, they focus on such feel-good issues as jobs created in the favored energy sector, overall growth in the favored sector that is produced by the incentives and mandates, and the "environmental benefits" expected. They carefully avoid the price increases.

They have to. Their own polling suggests they shouldn’t ask ratepayers to pay more than 50 cents more per electricity bill (see the wording change from 2013, question 8, to 2014, question 11), especially with a majority already thinking they pay too much for electricity and noticing that their rates are still increasing.

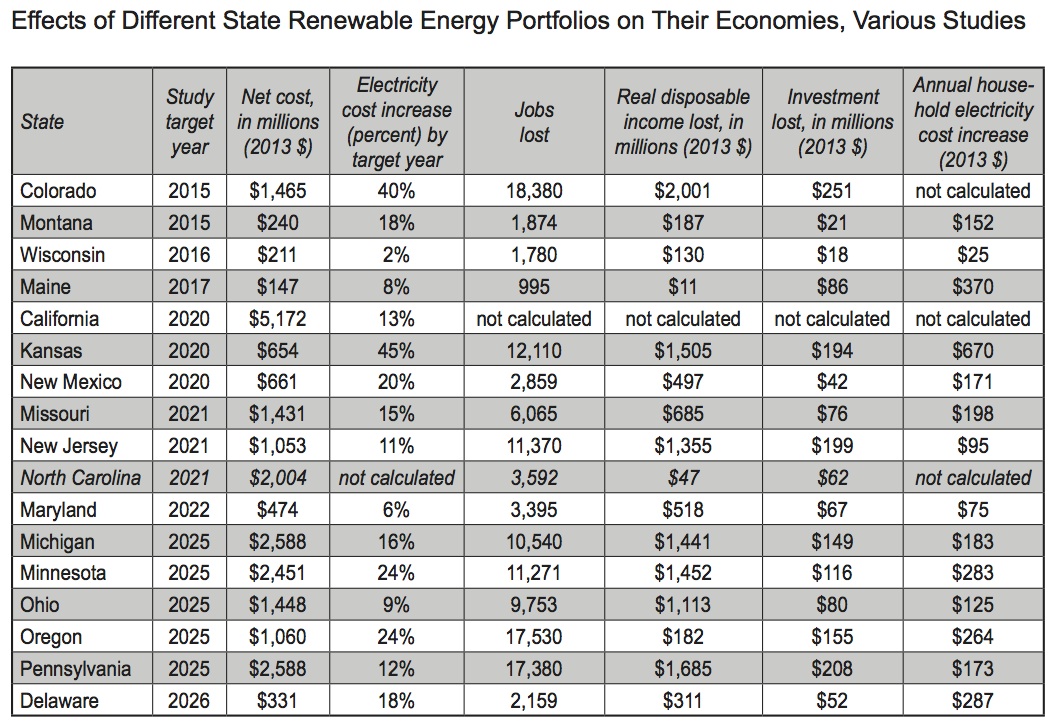

Nevertheless, state after state is learning that the impact of its RPS mandates on consumers is well over "50 cents" per month (i.e., well over $6/year) and those mandates are costing them jobs, income, and investment. This chart updates a previous compilation in my report on North Carolina’s RPS mandate and includes three additional studies on RPS mandates in New Jersey, Maryland, and Michigan):

Click the image for a larger version.

Ohio recently beat North Carolina to become first in flight from a costly state RPS mandate. Still, considering all the costs, second place would be much preferable to continuing in cronyism.

Click here for the Rights & Regulation Update archive.

You can unsubscribe to this and all future e-mails from the John Locke Foundation by clicking the "Manage Subscriptions" button at the top of this newsletter.