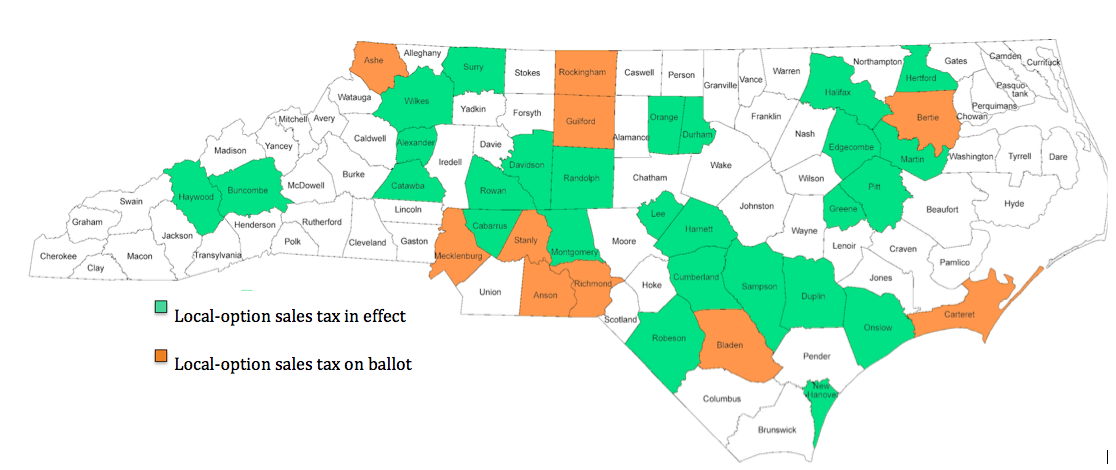

Anson County has only had a sales tax increase on its ballot one time prior, and that was in 2008. The decision to be placed on the ballot passed the county commission 7-0. The estimated $300,000 in revenue will be used for increased teacher supplements. Education makes up 15% of the county’s total expenditures, preceded by Public Safety (24%) and Health and Human Services (21%).

Ashe County placed a sales tax increase on the ballot for the first time. The tax is expected to increase revenue by $500,000 for the county’s General Fund budget of $34 million. The additional revenue is planned to help subsidize Ashe Memorial Hospital. In future years, county officials expect the money to fund other county building projects. Ashe currently spends $10.4 million of its budget on health-related services, or 31 percent of the General Fund budget.

Bertie County placed the sales tax on the ballot in May where it failed and will try again this November. County leaders have said they want the additional revenue to help them meet existing debt service payments and to make improvements to aging infrastructure. In the county’s most recent budget of $16.8 million, 15 percent was appropriated towards debt service.

Bladen County is on its third try to increase the sales tax. Voters rejected the tax in 2010 and most recently during the May 6th election this year by 72 percent to 28 percent. The tax is expected to generate between $350,000 and $500,000. County commissioners have said the tax will go towards capital improvements for education, yet they also say the county has needs in its jail and emergency medical services. To put this into perspective, the county’s budget for the year ending June 30, 2013 was $48.5 million, with the largest expenditure being debt service at 28 percent. Following are health services at 26 percent, public safety at 17 percent, and education at 15 percent.

Carteret County residents will vote on a sales tax increase for the first time in November. The county’s largest spending items are education at 27 percent and human services at 21 percent of the total county budget. County commissioners have said they would like the estimated $2.5-$2.6 million in additional revenue from the tax to pay for dredging and waterway care, usually a cost-sharing activity between counties and the state. Other commissioners have said they would like to use the money to fund school technology initiatives or combat drainage problems. The county currently spends 4.4 percent on environmental protection.

Guilford County residents will have the chance to vote on the sales tax increase a fourth time, with previous votes being held once 2010 and twice in 2008. The county is focusing solely on schools as the selling point for this sales tax referendum. An estimated $14 million would be generated from the tax and it has been said the additional funds will go toward funding classroom teachers, making repairs and maintaining facilities, buying more supplies and textbooks, increasing teacher compensation and incentives, and improving school security. The county already spends 48 percent of its nearly $568 million budget on education. Read this for a more in depth look at the Guilford debate.

Mecklenburg County has the largest county budget in the state at $1.5 billion and is voting for the first time on the quarter-option sales tax. According to the chairman of the county commission, eighty percent of the new tax revenue would go to raise the pay of Charlotte-Mecklenburg Schools employees, 7.5 percent to raise pay at Central Piedmont Community College and 7.5 percent to the Arts and Science Council. The remaining amount would go to the county’s public libraries. The county’s largest expenditure is on education services, amounting to 38 percent of the total budget.

Richmond County will vote on a sales tax increase for the first time, and the board of commissioners is using a recreational complex as the focus for the revenue. The tax is expected to collect between $600,000 and $700,000 a year. The initial phase of the sports complex will cost $10 to $12 million, with six other phases following for which no cost has been estimated. The superintendent of Richmond County Schools said, “our funding has been flat for the last few years. … I’m hoping that maybe we can get a bump this year depending on how this sales tax thing goes.” Currently the county spends 22 percent of its general fund on education, less than one percent on economic development, less than one percent on parks and recreation, and 8.5 percent on debt service.

Rockingham County held a sales tax referendum once before in 2008, making this the second time the sales tax increase has been on the ballot for residents. Expected to generate $1.5 million per year, the sole purpose touted for this tax has been education. The county has specifically stated it will spend it on construction, repairs, equipment, and debt repayment for both the public schools and the community college. The county’s total budget is $124 million, with 19 percent spent on education and education debt. Sales taxes are the smallest revenue source for the county collecting only $10.7 million per year.

Stanly County once voted for a sales tax increase in 2008; voters will now have a second chance to increase their sales tax. Commissioners have stated their intent for the new revenue to pay debt and capital expenses associated with the construction, operation and maintenance of a new public safety/911 emergency radio communications system and related radios. In addition, they have said workforce education, and school debt will also be a primary focus. The new radio system is expected to cost $775,000.