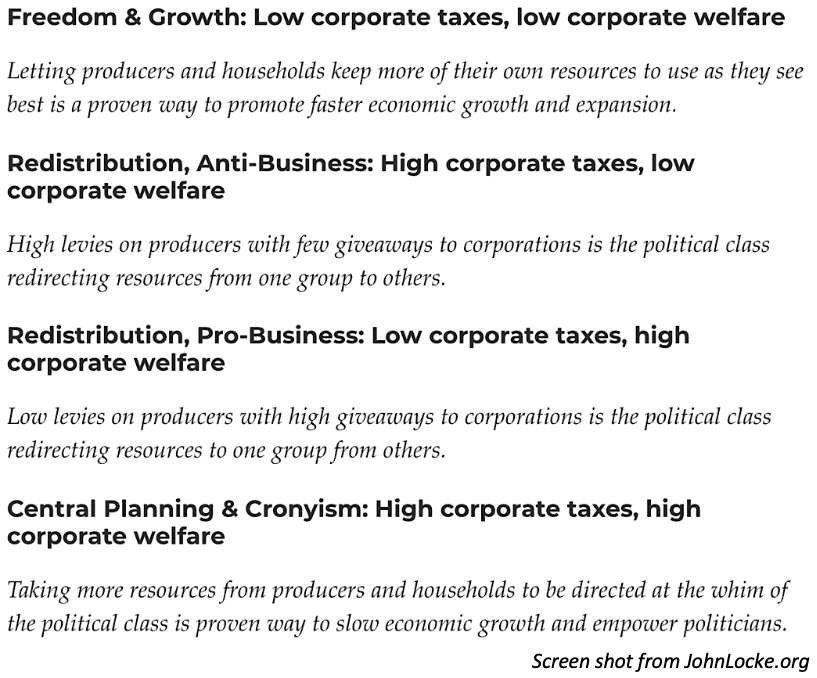

Earlier this week, JLF’s Director of Regulatory Studies, Jon Sanders, published a research brief on Corporate Welfare. His piece establishes the four basic combinations of corporate taxes and corporate handouts (see image).

Sanders writes that the most recent debate on corporate welfare in North Carolina has centered around the legislature’s efforts to lower the franchise tax.

Sanders writes that the most recent debate on corporate welfare in North Carolina has centered around the legislature’s efforts to lower the franchise tax.

According to Sanders, the franchise tax is:

a double tax on corporate assets, not income. As such, it allows the state to tax business expenditures, including on capital and equipment, things that would be fully deductible under the corporate income tax.

North Carolina is one of only 16 states to impose a franchise tax, and, in most years, is the government’s fourth largest source of revenue. The governor is adamantly opposed to cutting the franchise tax. While Gov. Cooper and the General Assembly do not see eye-to-eye on the franchise tax, Sanders explains:

The governor and legislature were in rare agreement when it came to passing massive incentives for “transformative” corporate projects, such as Amazon’s or Apple’s. Legislative budget-writers have made sure the state’s corporate incentives programs, such as the Jobs Development Investment Grant (JDIG) and One North Carolina (OneNC) grant programs, are flush. The governor is making ample use of them, announcing nearly $70 million in the last three months to 35 different companies.

Sanders believes, between attempts to cut corporate taxes and the significant corporate welfare, North Carolina is being pulled between a “Redistribution, Pro-Business” model and a “Central Planning & Cronyism” model.

Sanders hopes we can move more towards a “Freedom & Growth” model in the future.