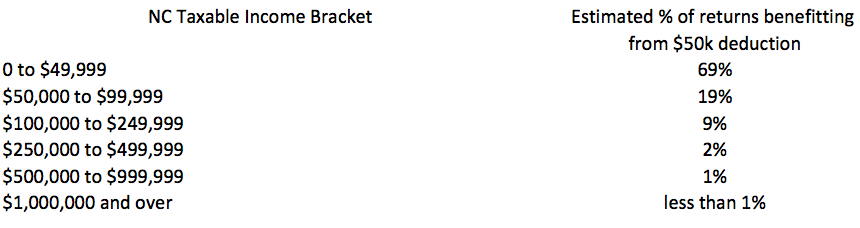

Is anyone else tired of the left’s continued accusations that the 2011 General Assembly’s $50k tax break to help small businesses went to help wealthy law firms and millionaires instead? NCGA fiscal research division estimates that less than 1% of those filing for the break will be in the $1 million tax bracket.

Will the $50k deduction help small businesses? You bet – 69% of all the tax returns in the under $50,000 tax bracket will benefit from this particular tax break. 88% of those benefiting from the break will be businesses earning under $100,000 a year. And that’s what the business earned not what the owner got paid. Know who those guys are? Contractors, barbers, landscapers, moms who sell Tupperware and Mary Kay to pay for their kids’ school clothes – you know, real small businesses trying to survive.

Enough of the rhetoric from the left. Let’s get the facts straight folks. Tax breaks to help small businesses passed last session are expected to do just that – help small businesses.

Here’s the chart from NCGA fiscal research: