Obamacare’s idea of nudging businesses and their workers to be more cost-conscious on health care spending is to levy a hefty tax on loaded health plans. ‘Repeal and Replace’ proposals aim to do so by capping the employer tax exclusion. Both proposals share similarities, but Obamacare’s ‘Cadillac tax’ fares worse. Even Hillary and Bernie don’t approve.

Set for implementation in 2018, a 40 percent tax will kick in on the amount exceeding the following thresholds:

- Individual health plans costing more than $10,200

- Family health plans costing more than $27,500.

Here’s why the Caddy is due for an inspection:

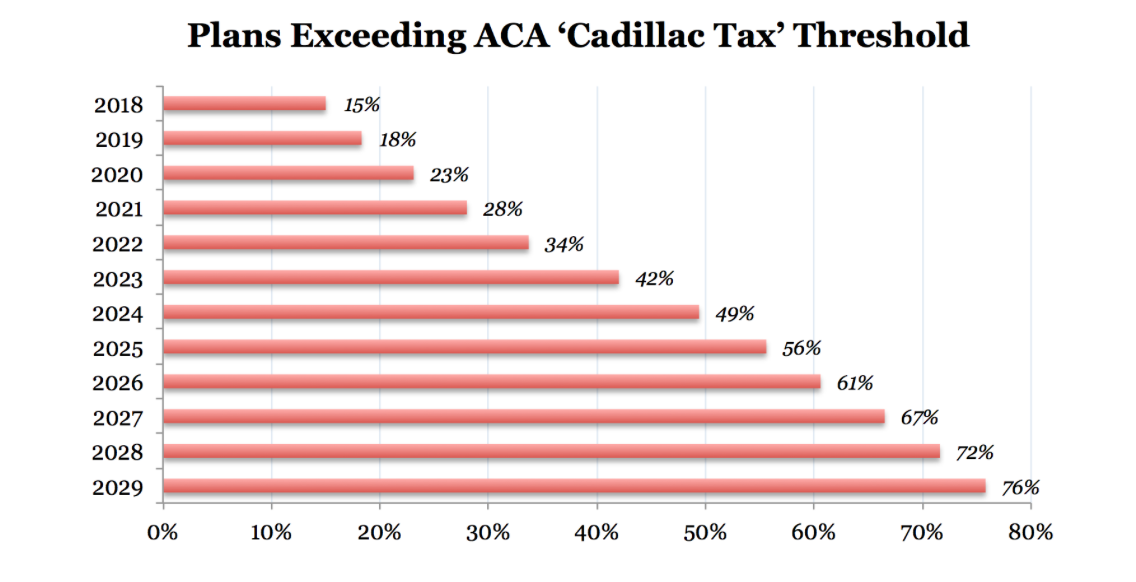

1. The thresholds are adjusted annually to keep up with the Consumer Price Index (CPI) + 1 percent, but not medical inflation. Because medical inflation surpasses CPI, this means that the tax will creep up on an increasing number of health plans in subsequent years. Estimates of the percentage of plans affected over the next decade ranges from 42 to 90 percent:

2. Combined with the fact that the thresholds don’t keep up with medical inflation, the Cadillac tax ironically prevents the consumer awareness behavior that it tries to promote. For an individual, that $10,200 cap includes any health savings account (HSA) contribution made by his or her employer.

3. Low-income workers will take a stronger financial hit under the penalty over an employer tax-exclusion cap. Chris Conover at Forbes explains:

“Thus a minimum wage janitor will be paying the same 40% tax as the CEO making $1 million. In contrast, if the tax exclusion were capped, the minimum wage janitor would pay only 15.3% (i.e., FICA payroll taxes for Social Security and Medicare) whereas the CEO might pay in excess of 50%.”

For more information on the bipartisan-panned tax, check out these articles here, here, and here.