Obamacare certainly rains, not reins in, burdensome taxes. Federal budget negotiations now focus on another tax under the federal health law – the “reinsurance tax”. The reinsurance tax applies to any company that provides health insurance (big businesses, labor unions, insurance carriers), where a $63 fee is assessed on not just every worker or individual, but dependents as well. Because of this, The Wall Street Journal refers to the “reinsurance tax” as the “belly-button tax”.

The reinsurance tax has a lifespan of three years and is supposed to kick in at the start of the New Year. The majority of the estimated total of $25 billion will be designated as a fund for individual insurers to offset the cost of high-risk individual policy holders both on and off the exchanges. It will also serve as a pain reliever for these insurance companies when young and healthy invincibles refuse to sign up for costly health plans.

High-risk individual policy holders will therefore benefit at the extra expense of those who do not even participate in the individual marketplace, such as small businesses, large businesses, and the self-insured.

As of now, the Senate is considering a delay of the reinsurance tax for one year in an attempt to reopen the federal government and extend the debt ceiling.

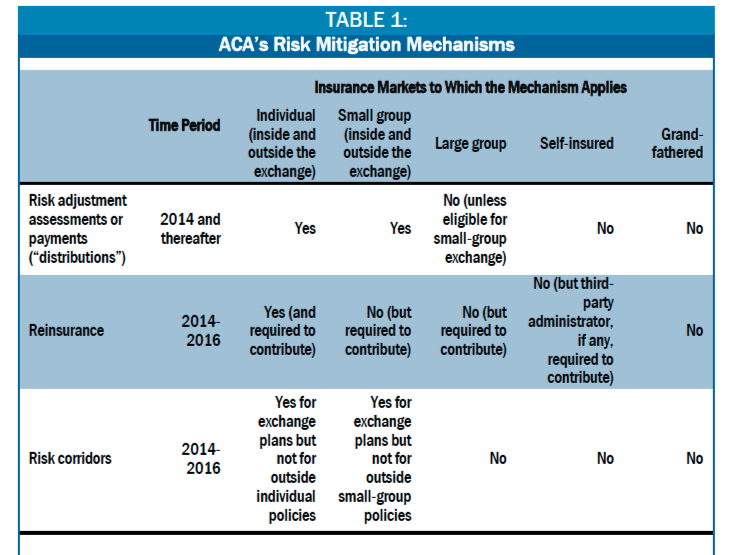

Read more about the reinsurance tax here and here. See below the chart outlining who must contribute and who will benefit.