Bruce Yandle writes for The Hill about the Inflation Reduction Act’s ability to live up to its name.

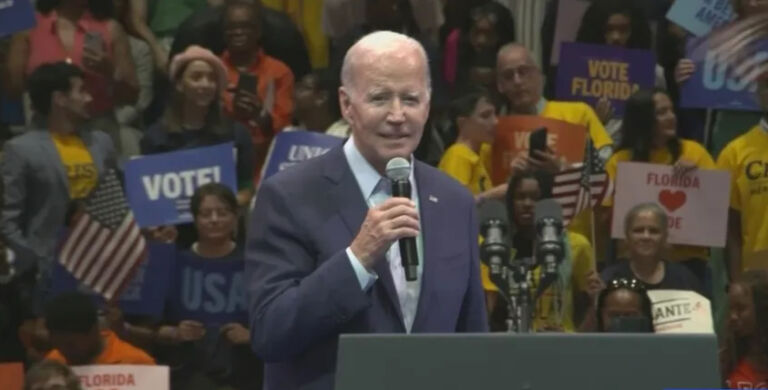

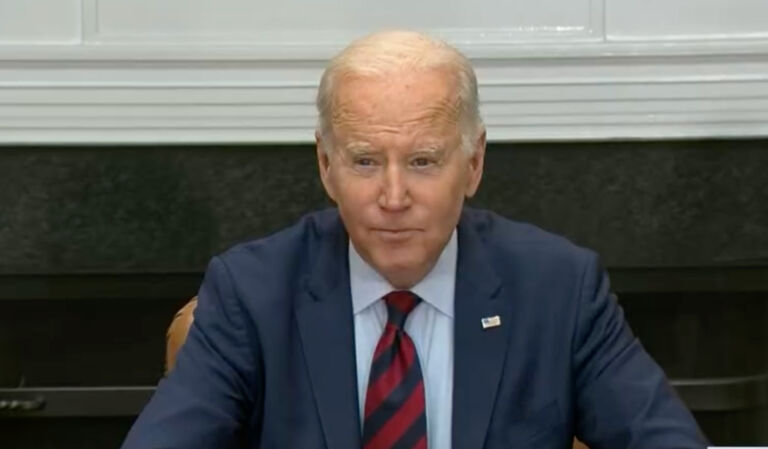

By signing the Inflation Reduction Act of 2022 (IRA) into law, President Biden brought to fruition a major effort to confront climate change, health care costs, clean (and not-so-clean) energy development, minimum corporate income taxes and taxes on financial transactions engaged by some of America’s wealthiest firms and individuals. By any measure (the new law comes in at more than 700 pages long and authorizes more than $700 billion in spending) and by reach of implied federal action, the IRA is a major legislative action.

But what about inflation? Does the statute deliver the goods implied by its name? Or are these politically useful words merely a case of deceptive and misleading advertising? If so, should the Federal Trade Commission (FTC) get involved in the name of consumer protection or, as the case may be, voter protection?

Well, come on. Of course not. The FTC polices the private marketplace, not politics. Still, let’s consider what might happen if we held our lawmakers to a similar standard and FTC enforcement entered the picture.

Interestingly enough, the Biden administration tends to change the subject when asked to put dimensions on the inflation reduction that may be generated by the IRA. Indeed, when pushed during an Aug. 8 National Public Radio interview to talk about inflation, Brian Deese, director of the Biden administration’s National Economic Council, brushed against the matter but spoke more fully about how the new law would cap the annual cost of individuals’ prescriptions at $2,000, provide subsidies for the purchase of electric automobiles and empower Medicare to bargain with pharmaceutical companies so as to hammer down drug costs.

Deese’s response was not about inflation (what happens to all prices taken together) but about the relative prices of some important items purchased by consumers.