There are seven counties with quarter-cent increases to their sales taxes on the ballot in November. For Ashe County, this will be the first time on the ballot.

While many local governments claim they will collect the tax for a specific purpose, that is not permissible by law. Any revenue generated from the local-option, quarter-cent sales tax is considered general revenue and can be spent on anything in the county’s budget. County commissioners typically pledge to spend the tax revenue on a specific area of the budget, but there is no legally binding way to ensure that will happen. Rather, each governing board can decide where to spend the money – regardless of the promises made to voters.

The Ashe Mountain Times reported stating,

“According to Ashe County Manager Sam Yearick, this one-fourth cent sales tax is projected to increase the county’s tax revenue by $500,000 for the year.

The additional revenue, if the referendum is approved, will be used to offset a $500,000 subsidy to Ashe Memorial Hospital, which was established in Ashe County’s 2014-15 budget.

According to Yearick, the additional revenue will continue to stabilize Ashe Memorial Hospital. Afterword, the revenue will be used to fund other county building projects.”

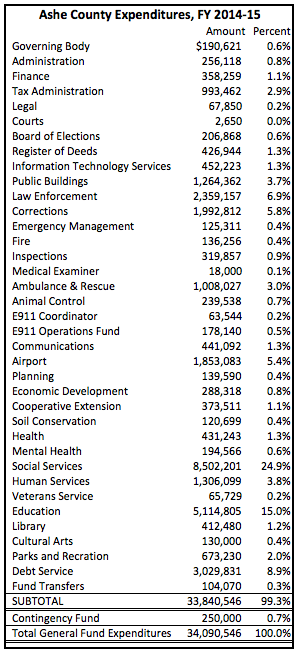

Ashe County has a general fund budget of $34 million and a total budget expenditure of $40.4 million for fiscal year 2014-15. The $500,000 has already been appropriated to Ashe Memorial Hospital under Social Services, yet the vote is not scheduled to occur until November. So the county has already budgeted the amount for the hospital as if the sales tax has already passed. It seems commissioners are using the hospital as a reason to encourage voter support and if the tax passes they will have another $500,000 to use in the next year’s budget. The county has other areas that could be cut in order to alleviate funds within the budget for other uses rather than increasing taxes on residents, such as services that are not a function of government.

Below is a chart of expenditures according to the categories listed in the Ashe County approved budget for fiscal year 2014-15. You decide if there are ares in the budget that need to be cut instead of a sales tax – or should the new revenue be put towards another area of the budget?