Editors at National Review Online explain why one of the world’s richest men has pegged President Biden’s flawed approach toward inflation.

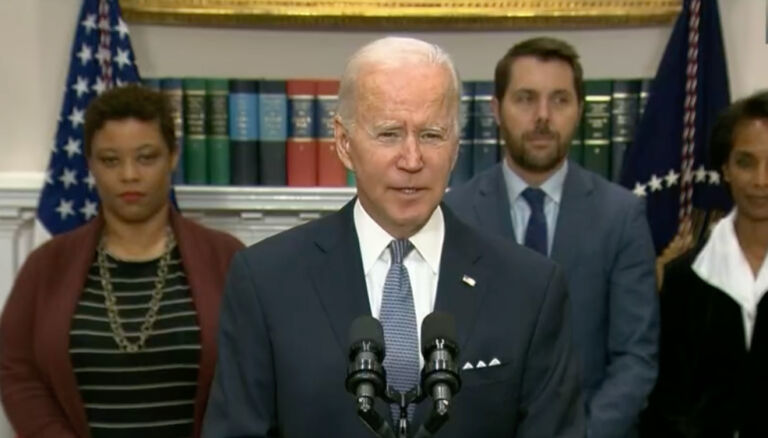

Lowering the price of consumer goods by raising the cost of producing them — President Biden can be, to put it charitably, counterintuitive.

The Biden administration is in an entertaining public spat with what we might as well call the “Bezos administration” (Amazon’s annual revenue exceeds the GDP of most European countries), and, while our faith in the man who publishes the Washington Post is something quite a bit less than total, in this case Jeff Bezos is unquestionably in the right — and not just because the Biden administration has an uncanny knack for being wrong on every economic question at every possible opportunity.

Biden has proposed to fight inflation by raising corporate taxes. As Bezos was quick to acknowledge, there is a case to be made for raising corporate taxes (we are not persuaded by that case, but there is a good-faith argument there), and certainly there is a crying need for an anti-inflation policy — but to pretend that these are the same thing is economic illiteracy.

The Biden administration has an inflation problem — because America has an inflation problem — but the administration is by and large unwilling to do the things that are in its power to actually address that problem, because such measures are likely to be politically difficult for a White House in which the reflexive response to any problem is to throw money at it. Inflation is a problem that is famous for getting worse when you throw money at it, and for getting better when you stop.

As Bezos points out, Biden and many of his congressional allies tried to throw even more money at our already-overheated economy and were saved from their own worst inclinations only by the relative sobriety of Senator Joe Manchin, the West Virginia Democrat whose willingness to buck his party has made him, for the moment, the most powerful man in Washington.