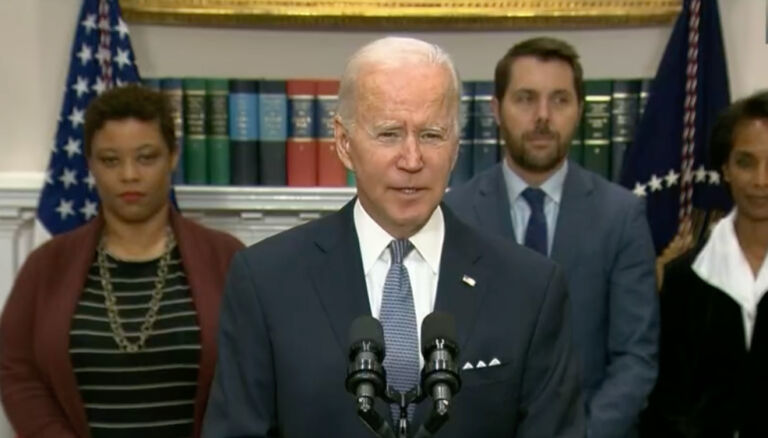

Joe Popularis writes for the Federalist about Sen. Joe Biden’s role in creating a problem President Joe Biden has targeted with a recent student loan amnesty.

There’s a lot that’s wrong with Biden’s student debt forgiveness plan — morally, economically, and legally. The plan is fundamentally unfair; many experts think it will be inflationary, and it’s almost surely illegal under Supreme Court case law. But that’s not the whole story: As a senator in 2005, Joe Biden pushed changes in bankruptcy law on behalf of the credit card industry that helped precipitate the student debt crisis. …

… In general, borrowers burdened by too much debt and unable to pay their loans can usually discharge them in a personal bankruptcy case. Some debts, particularly those owed to the government, are not dischargeable. But consumer loans and credit card debts generally are dischargeable. Before 2005, young people who were overwhelmed by student loans from private lenders were able to get relief by filing for bankruptcy. Even student loans from the government had been dischargeable before 1976, though that was later changed.

The upside of bankruptcy for the debtor is that the slate is wiped clean. But there’s a major downside to bankruptcy: Your credit rating is shattered. You’re a proven bad risk, and if lenders deal with you at all in the future, they’re likely to demand high-interest rates or substantial collateral or both. But that’s just as it should be: You shouldn’t be able to walk away from your debts and stiff your creditors with no consequences at all. Fear of being branded a bad risk is a healthy incentive either not to borrow too much or to pay up if you can.

Those were the normal rules and incentives before Biden led a group of 18 Democrat senators in supporting changes in the bankruptcy law in 2005. One of those changes barred most student debtors from being able to discharge their private loans.