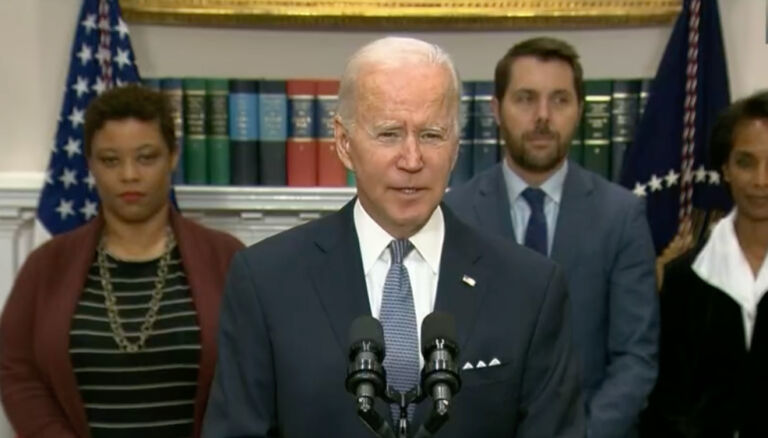

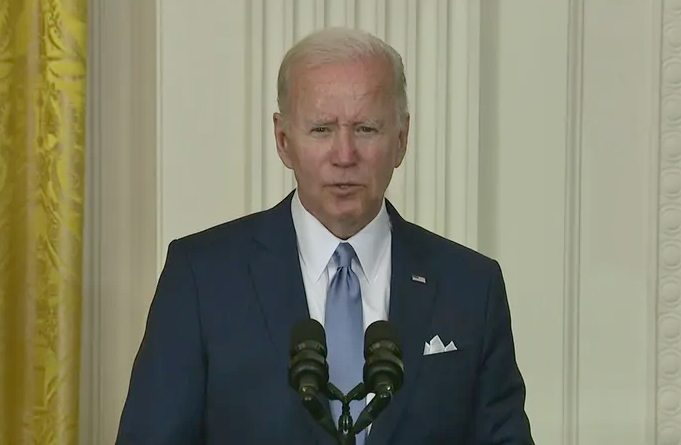

Editors at Issues and Insights share their concerns about the Democratic presidential nominee’s tax proposals.

Facing perhaps their important election ever, Americans have much to worry about: Urban riots and political violence, a loss of respect for our basic constitutional rights and American institutions, and the spate of socialist-inspired radical policy proposals from the Biden campaign. Here’s one more thing: the ruinous taxes you’ll have to pay for the left’s socialist wish-list if Joe Biden wins.

A recent study by a group of highly regarded economists at the Hoover Institution, including two former members of the Council of Economic Advisers, found that the full panoply of Biden’s policy proposals — Medicare for All, big tax hikes on the wealthy and the working poor, the massively expensive Green New Deal, and thousands of impending regulations — would have devastating consequences for the U.S. economy.

Why? Not only would they destroy the economy’s current renewed momentum, but they would require enormous tax increases on all Americans, businesses and individuals alike. It would hit the U.S. economy with its largest tax shock ever, and take it down.

The size is beyond dispute. As President Donald Trump would say, the coming tax-hike tsunami from Bidenomics would by “Yuuuge.”

According to the nonpartisan Committee for a Responsible Federal Budget, Biden’s projected tax increases total $4.3 trillion over the next decade, and that’s a conservative estimate. Trump, meanwhile, would cut taxes by about $1.7 trillion. The quick math: That’s a $6 trillion difference.

“We estimate that the full Biden agenda will reduce long-run real GDP per capita by more than 8% as a result of reducing full-time equivalent employment (FTEs) per person by 3%, the capital stock per person by 15% and total factor productivity by 2%,” the Hoover Institution study said.

Based on current growth estimates by the nonpartisan Congressional Budget Office, “this suggests there will be 4.9 million fewer employed individuals, $2.6 trillion less GDP. …”