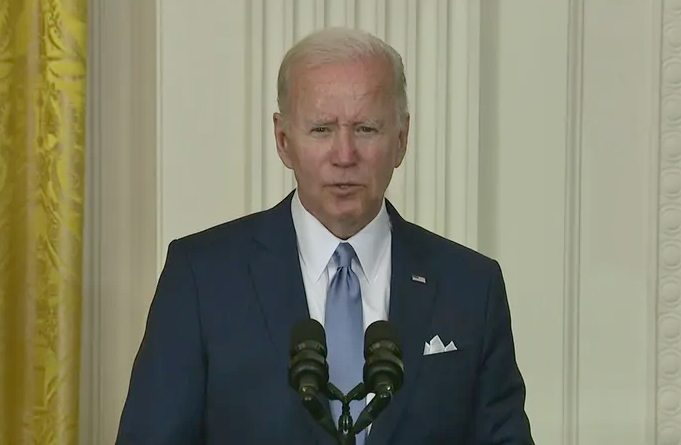

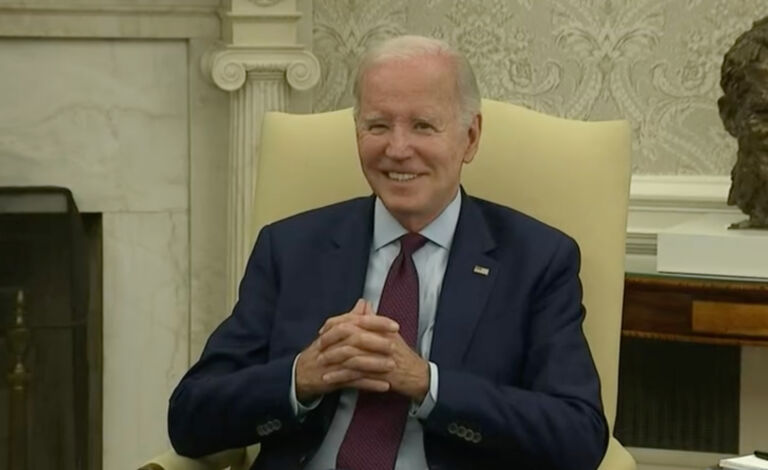

Daniel Pilla explains at National Review Online how President Biden’s tax proposals would affect more than just “the rich,” regardless of his administration’s rhetoric.

President Biden’s promise to raise taxes only on the richest Americans cannot possibly be upheld if he is successful with the centerpiece of his tax plan. That, of course, is to repeal the Tax Cuts and Jobs Act (TCJA) passed during the Trump administration. The primary effect of the TCJA was to reduce taxes for Americans in the bottom 80 percent of the income distribution. Put another way, the top 20 percent of earners were the only ones who did not get a tax cut under the TCJA. Americans earning between about $40,000 and $80,000 per year benefited most from the TCJA, and millions of others at the lowest income levels were taken off the tax rolls altogether.

President Biden, along with House and Senate Democrats, have pledged to reverse all that.

For example, the president vows to eliminate the so-called “stepped-up basis” rule for inherited property. The president refers to this as a “loophole” that allows the rich to game the system. It is no loophole. In fact, it is a specific rule of law under Internal Revenue Code §1014. This law was not a part of the TCJA. It has been on the books since 1954 but is only now under attack by Democrats looking for ways to take more of your money.

Here’s how it works.

Suppose your parents own a home worth $200,000. They purchased the home decades ago for, say, $50,000. If they gift the home to you prior to their passing, your basis in the home is the same as theirs: $50,000. That means if you sell the home for its current value of $200,000, you must pay capital gains tax on the profit of $150,000 — the difference between basis and sale price.