Democratic state senator Wiley Nickel of Wake County is pushing a carbon tax. As Locke’s Brian Balfour notes: (emphasis is mine)

The “carbon tax” bill is designed to punish the use of greenhouse gas emissions under the guise of protecting the environment. Such a tax would of course make business activity more expensive, serving to either depress worker wages or inflate the price of goods and services purchased by consumers. Either way, low-income workers and households would be hardest hit.

That’s such an important point, one that too often goes undiscussed.

Progressives understand that when you tax an activity, you get less of it. That’s why they support so-called ‘sin taxes’ on tobacco, soda, guns, etc. Their goal is to decrease the use by making it cost more. Locke supports a fair and neutral tax code – one that doesn’t pick winners and losers.

Back to the carbon tax. As Brian points out in a conversation with Mitch Kokai, a carbon tax would have a similar impact as a ‘sin’ tax. Watch Brian explain this further.

Those who try to save the planet by taxing carbon emissions should understand they are also likely to hurt the people who need help most.

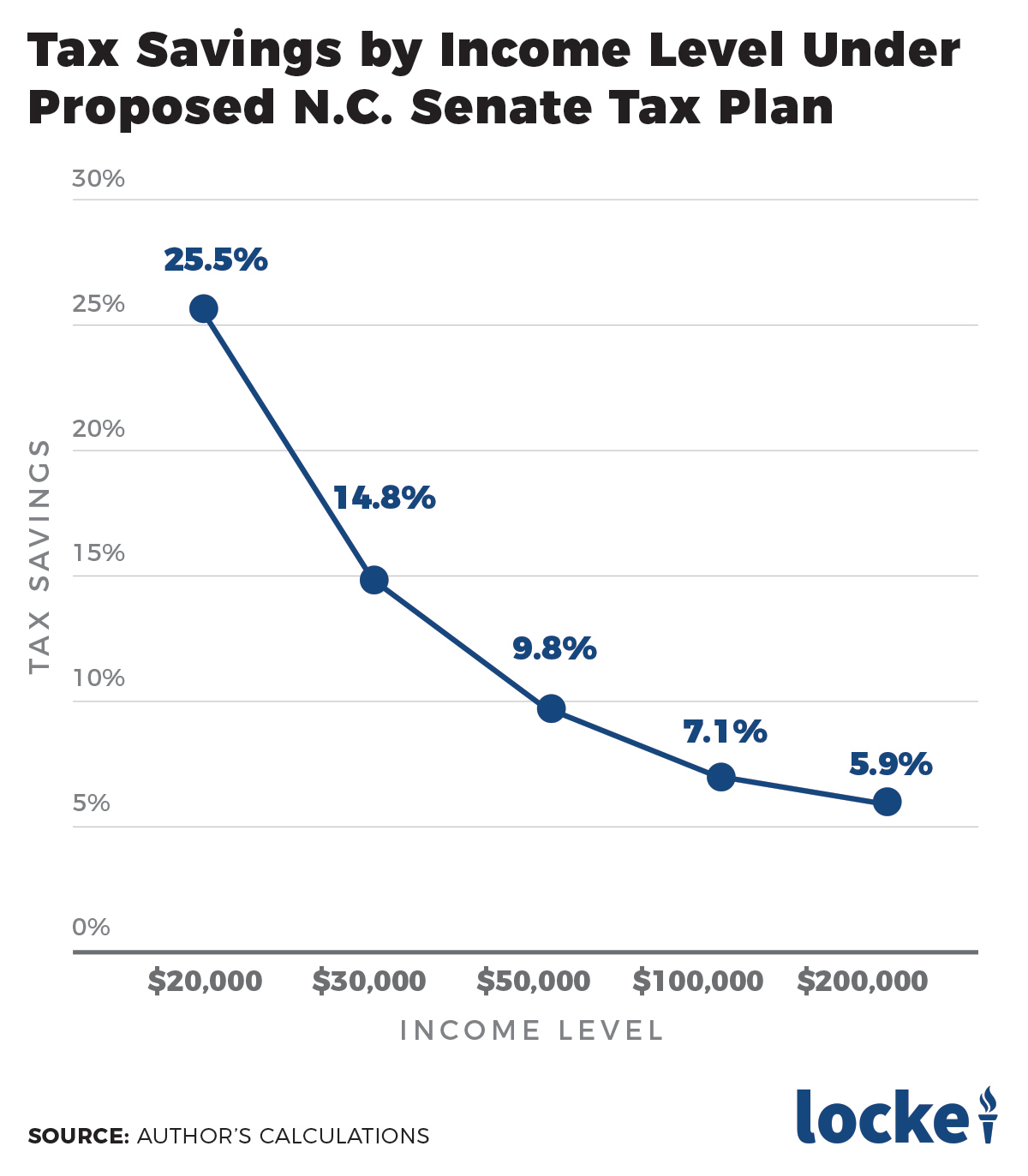

Really want to help the most vulnerable? Make sure they keep more of what they earn. Republican legislators would do that under their tax-cut proposal, as Mitch Kokai explained here.

The $20,000 earner would see his income tax bill drop from $485 to $361. That’s a cut of more than 25%. At $30,000, the bill drops from $1,010 to $860 (15% cut). At $50,000, the bill drops from $2,060 to $1,858 (almost 10% cut). At $80,000, the bill drops from $3,635 to $3,355 (8% cut). At $100,000, the bill drops from $4,685 to $4,353 (7% cut). At $200,000, the bill drops from $9,935 to $9,343 (6% cut). At $1 million, the bill drops from $51,935 to $49,263 (5% cut).

It’s clear which proposal helps the poor, and which proposal doesn’t.