Harold Hutchison reports for the Daily Caller about a warning based on a serious economic threat.

A prominent billionaire investor said the U.S. faces a debt crisis during a discussion at CNBC’s Delivering Alpha conference.

“We’re — we’re in deep trouble. So everything I said at those colleges is worse in terms of the metrics, except for one thing. And what I miscalculated was I didn’t calculate zero rates, I used 4 percent rates,” Stanley Druckenmiller, who founded Duquesne Capital Management and ran it until August 2010. “But the only thing Donald Trump and Hillary Clinton agreed on in 2016 was don’t cut Social Security, don’t cut entitlements. So nothing was done.”

The national debt is more than $30.9 trillion and is 124.9% of America’s gross domestic product (GDP), according to UsDebtClock.org. The U.S. has unfunded liabilities for Social Security and Medicare of more than $171 trillion, UsDebtClock.org reported.

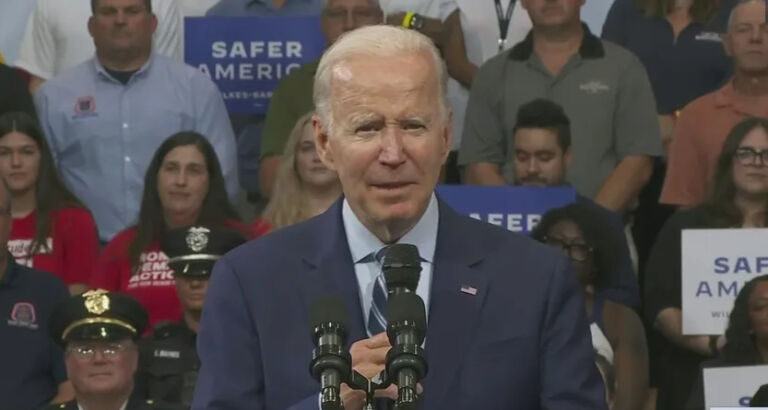

“Joe Biden has excoriated Rick Scott, because he dared to mention that maybe we shouldn’t be increasing senior paids. But if you look at — at the reversal, I just talked about and use the CBO estimate, which is rates at 3.8 percent, which I think frankly, is pretty optimistic, given all the things we talked about, by 2027, the interest expense alone on the debt, eats all health care spending,” Druckenmiller said. “By 2047 it eats all discretionary spending. So we’re now getting into fiscal dominance. By the way, by ‘49 it eats all Social Security. We’re getting to the point now where the interest expense on the debt is so high, that is going to eat up our ability to basically service the next generation and I’m not even sure about the current one.”

“The U.S. government is deeply in debt. While measuring the country’s fiscal position in trillions of dollars or percentage points of GDP may seem abstract, the adverse consequences of continuing on our current trajectory are real,” the Committee for a Responsible Federal Budget said in a 2019 paper.