It is easy to become complacent, to think that things now are as they always have been and always will be. But as Heraclitus and Disney’s Pocahontas both remind us, you can never step in the same river twice. After a decade of fiscal crises to pay for higher spending from 2001 to 2011, the past four years of lower tax rates and slower budgetary growth can seem like an oasis of calm, or like a drought waiting for the floodwaters to return and nourish the land depending on one’s perspective.

The budget on Gov. Roy Cooper’s desk reduces the per capita cost of state government adjusted for inflation, takes steps to address the longer term with $263 million more in savings and a coming end for some promises that cannot be kept, and wisely provides broad tax relief instead of narrow carve-outs. The margin for higher appropriations and lower tax rates is getting thin, so future budgets may require a cautious approach to one or both sides.

Taxes

Broad reductions in tax rates or the standard deduction do not give the state’s revenue to anybody. They limit the ability to of legislators to turn that revenue into spending and giveaways. A larger standard deduction has a greater impact for those with less income and makes itemized deductions less appealing.

Lower franchise taxes reduce the cost to North Carolinians of starting or growing a business in North Carolina without picking who deserves to make a profit and what industries are fashionable (energy suppliers, Hollywood studios, or multinational companies seeking the highest bidder).

Tax changes in the biennial budget are generally broad-based, with lower corporate and personal income tax rates, a higher standard deduction, repeal of the sales tax on mill machinery, and a reduction in the franchise tax for small companies. Legislators could have reduced tax burdens in ways that provided more marginal economic gains, such as by an across-the-board reduction in the franchise tax rate. Fortunately, they did drop a proposed reduction in the mortgage interest and property tax deduction that would have had little benefit for most families or the economy.

Spending and Saving

Teachers receive on average a 9.6 percent pay raise over two years, state employees receive a $1,000 raise, and other state-funded salaries also rise. Across all agencies the state will pay $642 million or 5.6 percent, more in salaries from the General Fund in FY2018-19 than in FY2016-17. Adding health insurance and retirement benefits to salary, total compensation climbs $967 million, or 6.5 percent. The budget also includes a provision (Section 35.21) to study whether the state is allocating compensation resources in the best way for all employees, and to address the unfunded liability for future health care costs.

Overall General Fund appropriations grow $1.3 billion, or 5.9 percent, over two years. Such budgetary restraint means that state government takes less, adjusted for inflation, from every North Carolinian.

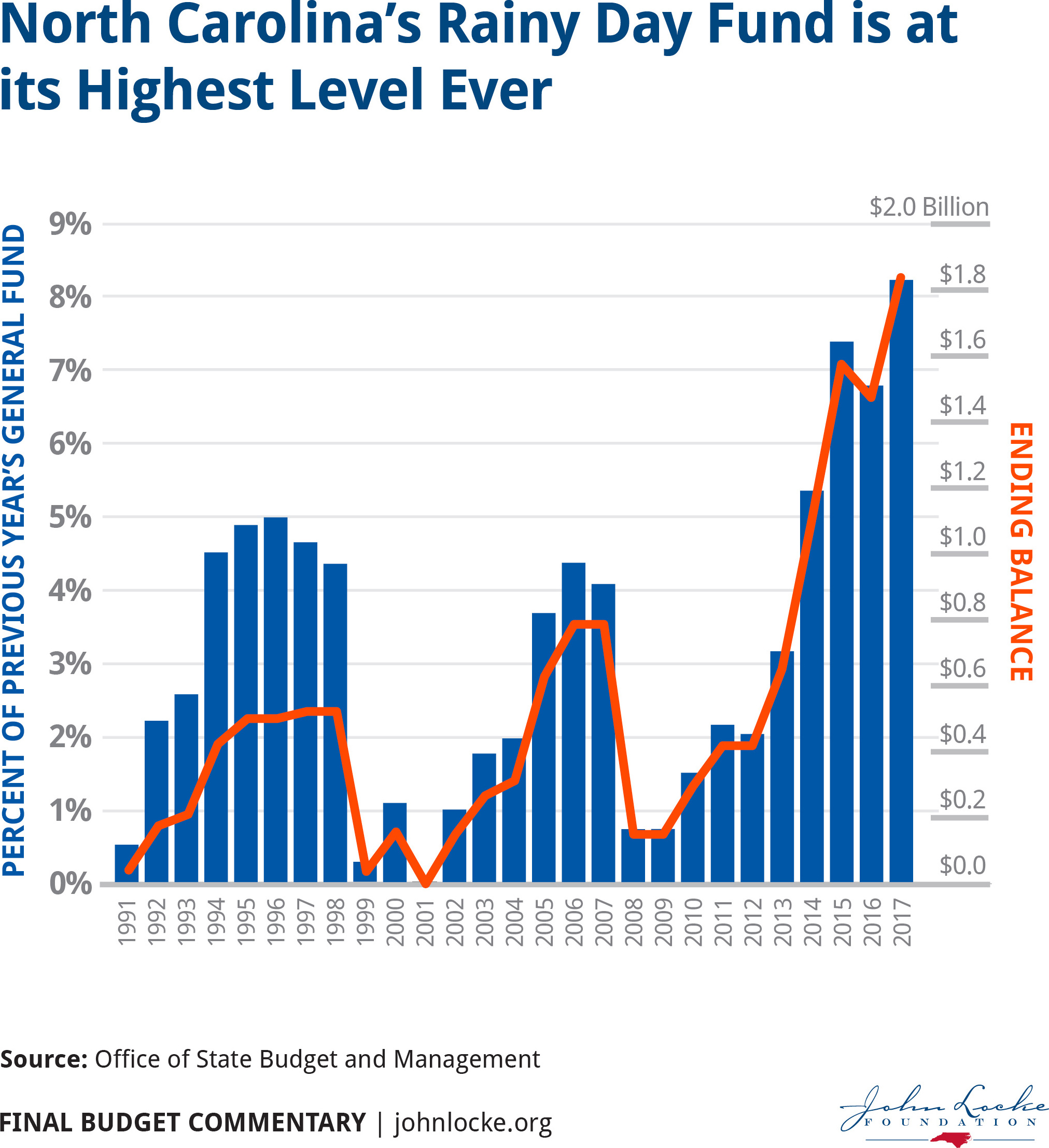

When government spends less than it collects in taxes, there is more opportunity to address unfunded liabilities or respond to emergencies like hurricanes, wildfires, or economic downturns. The Savings Reserve Account, state government’s rainy day fund, is about equivalent to a month of spending, still nowhere near the share of annual state spending necessary to weather a recession, but far more than spending increases in a given year and more as a share of spending than any time in previously. The General Assembly has created a mechanism to ensure its adequacy with mandatory transfers beginning in Fiscal Year (FY) 2018-19.

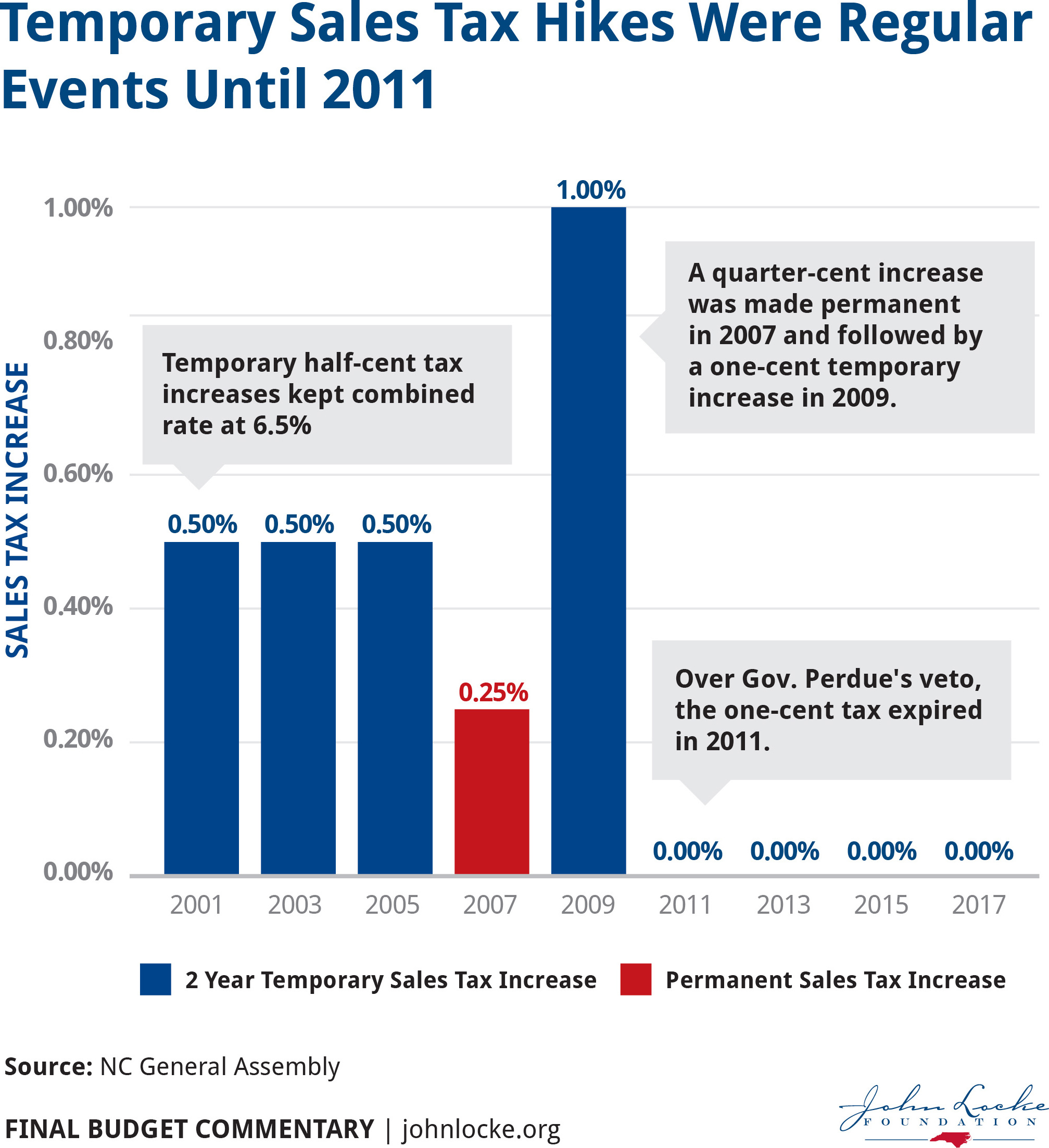

Low spending and an adequate rainy day fund should mean less temptation to hike taxes when the next recession comes. The budget is not set to spend every dollar and savings can offset some of the change. If spending and taxes are not on a roller coaster, people can make longer term plans. Sales tax hikes in the 2000s began as temporary. The first became permanent after repeated extensions; the second was kept temporary by the new Republican majority in 2011. Regularly renewed temporary taxes are no way to run a state.

Caution Ahead

The Republican General Assembly has had a good track record of assembling sound, fiscally-responsible budgets. Their latest General Fund budget, while less per person adjusted for inflation than authorized for the current year, sets a long-term path for appropriations and taxes that may require a future course correction.

In April, when we wrote that the Senate’s tax cut did not portend a looming crisis, our analysis was based on General Fund growth of roughly 2.5 percent per year. Instead, the conference budget adds 3.1 percent in the first year and 2.7 percent in the second year, which could go higher when the General Assembly makes adjustments in 2018.

The final bill also opens a gaping hole in what had been a firm baseline for spending with the addition of, “Adjustments for statutory appropriations and other adjustments as directed by the General Assembly.” Its main purpose is to incorporate annual $10 million increases in funding for Opportunity Scholarships, but it sets a troubling precedent, even when the funds support worthwhile programs.

Taxes, meanwhile, may be $1 billion lower each fiscal year once fully implemented. The $529 million tax cut legislative leaders advertised mostly takes effect in January 2019, which means just six months of the lower revenue shows up in the budget.

Conclusion

Despite our concerns, the potential challenges this budget could leave in the longer term are significantly different from the budgets passed between 2001 and 2010, when nonrecurring revenues were repeatedly tapped to cover recurring costs. Perhaps legislators will refrain from adding new appropriations when they return next year and keep the budget on track.