A new Cato Institute bulletin (PDF link) compares the effective corporate tax rates of 90 countries, including a subset of 34 countries tied to the Organization for Economic Cooperation and Development.

If you’ve not followed the corporate tax debate closely, the results might surprise you.

If you’ve not followed the corporate tax debate closely, the results might surprise you.

The Obama administration has suggested reducing the federal corporate tax rate from 35 percent to 28 percent while broadening the tax base. Presidential candidate Mitt Romney has said that he would cut the corporate tax rate to 25 percent if elected. The urgency of tax reform incrased when Japan recently enacted a reduction to its corporate tax rate. That left the United States in the uncompetitive position of having the highest statutory tax rate in the world, with a combined federal-state rate of about 40 percent.

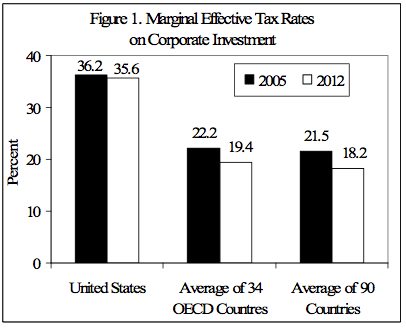

We find that the U.S. effective tax rate on new corporate investment is 35.6 percent in 2012, which is almost twice the average rate for the 90 countries studied, and it is also the highest rate among the major industrial nations. These results underscore the need for U.S. policymakers to tackle corporate tax reform.

Of course, the John Locke Foundation’s Roy Cordato offers an even better idea for North Carolina’s corporate income tax: Scrap it.