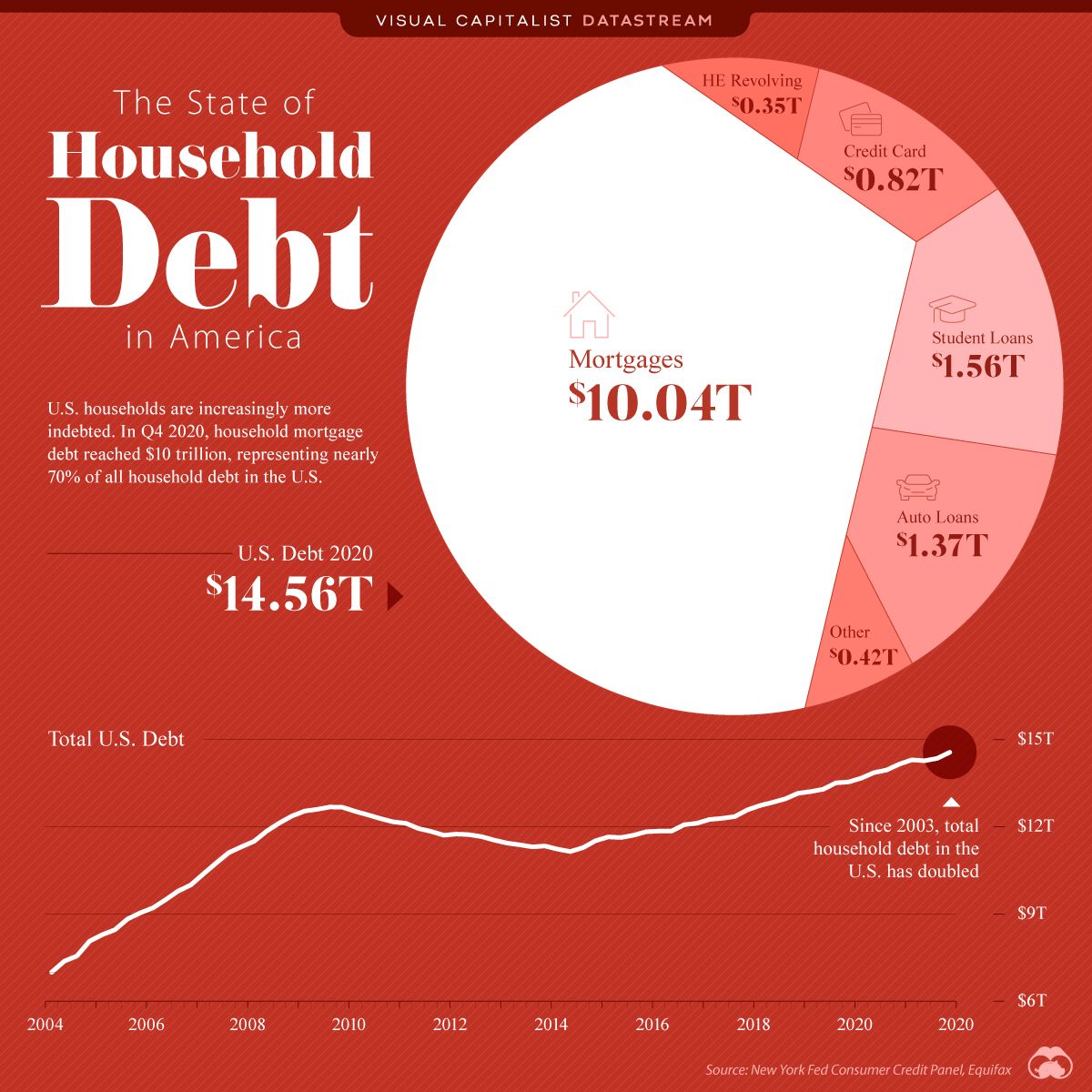

Household debt has doubled since 2003. American households are now $14.56 trillion in debt (still far less than the U.S. government’s whopping $28 trillion) which shakes out to around $118,000 per household, according to Visual Capitalist.

The chart below helps orient us to how the $14 trillion in American debt is divvied up. It’s clear mortgages bring down the house. It should be noted that Gen X carries a disproportionate amount of this mortgage debt (as well as credit card, student loan, and auto loan debt). Gen X ranges from around 41-55 years old and is likely in the midst of their peak earning years. Nonetheless, Millennials are quickly gaining on Gen X when it comes to the size of their mortgage debt.

A quick aside: One category of personal debt has climbed at a much faster clip than any other: student loan debt. The high school graduates of 2021 will enter a college landscape that has experienced a 550% increase in college debt holdings since 2003, the year some of these graduates were born. Over the past three decades, tuition has increased by 313%.

We all know college attendance is often viewed as a given in many quarters of society. No matter if you can’t yet afford it or it’s not suited to your vocational goals; It’s simply the thing to do. The federal government has done everything it can to ratchet up the pressure for young Americans to attend. Instead of approaching the college question with a degree of good faith inquiry, many young adults have jumped headfirst, accruing an average of $30,000 of debt by graduation.

When we compare the United States to the rest of the world, our level of household debt is certainly higher than many Central and South American countries, as well as several Eastern European nations. However, when it comes to our debt-to-disposable-income ratio, we’re doing better than our Scandinavian friends, as well as the United Kingdom and Japan.

Debt oftentimes adds a degree of stress to the person who accrues it. Although the stress associated with some forms of debt, such as a mortgage, is offset by the knowledge that you are (hopefully) making an investment that will one day pay off, credit card debt, and to a lesser degree auto loan debt, don’t afford individuals with the same level of comfort.

When it comes to dealing with debt, several state lawmakers recently made an attempt to pass a bill that would actually make it harder for individuals to reduce their consumer debt. House Bill 76 would have decimated the debt settlement business. Locke’s Becki Gray and Americans for Tax Reform’s Patrick Gleason wrote, “more than 68,000 North Carolinians used debt settlement services in 2020. People are putting their lives together and getting back on their feet.” Using a debt settlement company is typically not someone’s first choice in paying down their debts, but people deserve to have it as an option if they find themselves in dire straits. House Bill 76 would have prohibited North Carolinians from using such a company. Thankfully, the the Senate doesn’t seem interested in moving it forward.

Although financial literacy should be taught more rigorously in high school as a pre-emptive move to reduce consumer debt among the next generation, I don’t foresee the tide turning in the near term. National politicians spend the American people’s money with abandon and American individuals are taking on record amounts of debt. It’s time we revisit our relationship with money in this nation, both at the governmental and personal level. Until then, we will likely see the numbers on the chart above go discouragingly higher with each passing year.