Anna Allen writes for the Washington Free Beacon about the latest inflation numbers.

Consumer prices rose 0.1 percent in August, dashing many economists’ hopes that lower energy prices would be enough to cool inflation, the Washington Post reported.

The Consumer Price Index is up 8.3 percent over the last 12 months, the U.S. Bureau of Labor Statistics reported Tuesday. Food, housing, and medical care continue to see the largest price increases of the CPI contributors. While the inflation rate is a notch lower than it was in June and July, it is still higher than economists expected.

“We thought we’d see inflation start to come down, and instead what we’ve seen is inflation really sort of entrenched,” Betsey Stevenson, professor of public policy and economics at the University of Michigan and a former member of the White House Council of Economic Advisers, told the Post. “If there’s no real progress, then that says, ‘does the Fed need to take stronger action?’ And if the Fed needs to take stronger action, what does that mean for the risk to peoples’ livelihoods?”

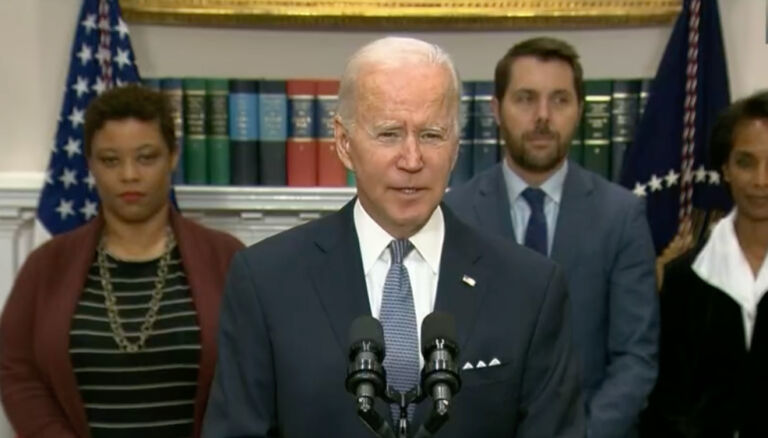

While Americans battle 40-year high prices for everyday consumer products, the Biden administration continues to throw billions of dollars toward climate and green energy initiatives, and President Joe Biden’s Inflation Reduction Act will do little to actually reduce inflation, economists say.

The 10.6 percent decline in gasoline prices was not enough to offset rising prices of other consumer goods. “The food index increased 11.4 percent over the last year, the largest 12-month increase since the period ending May 1979,” the Bureau of Labor Statistics reported.

“This was a disappointing report,” Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives, told the Associated Press. “It raises the risk of higher interest rates and a hard landing for the economy.”

With midterm elections two months away, the economy is still the main issue on voters’ minds.