The N.C. Senate’s “Billion-Dollar Tax Plan” could be even larger once final figures for 2016 income taxes are known in the next couple weeks. (By the way, don’t forget to file your taxes.)

Here are a couple things we discovered after a quick analysis of IRS tax data:

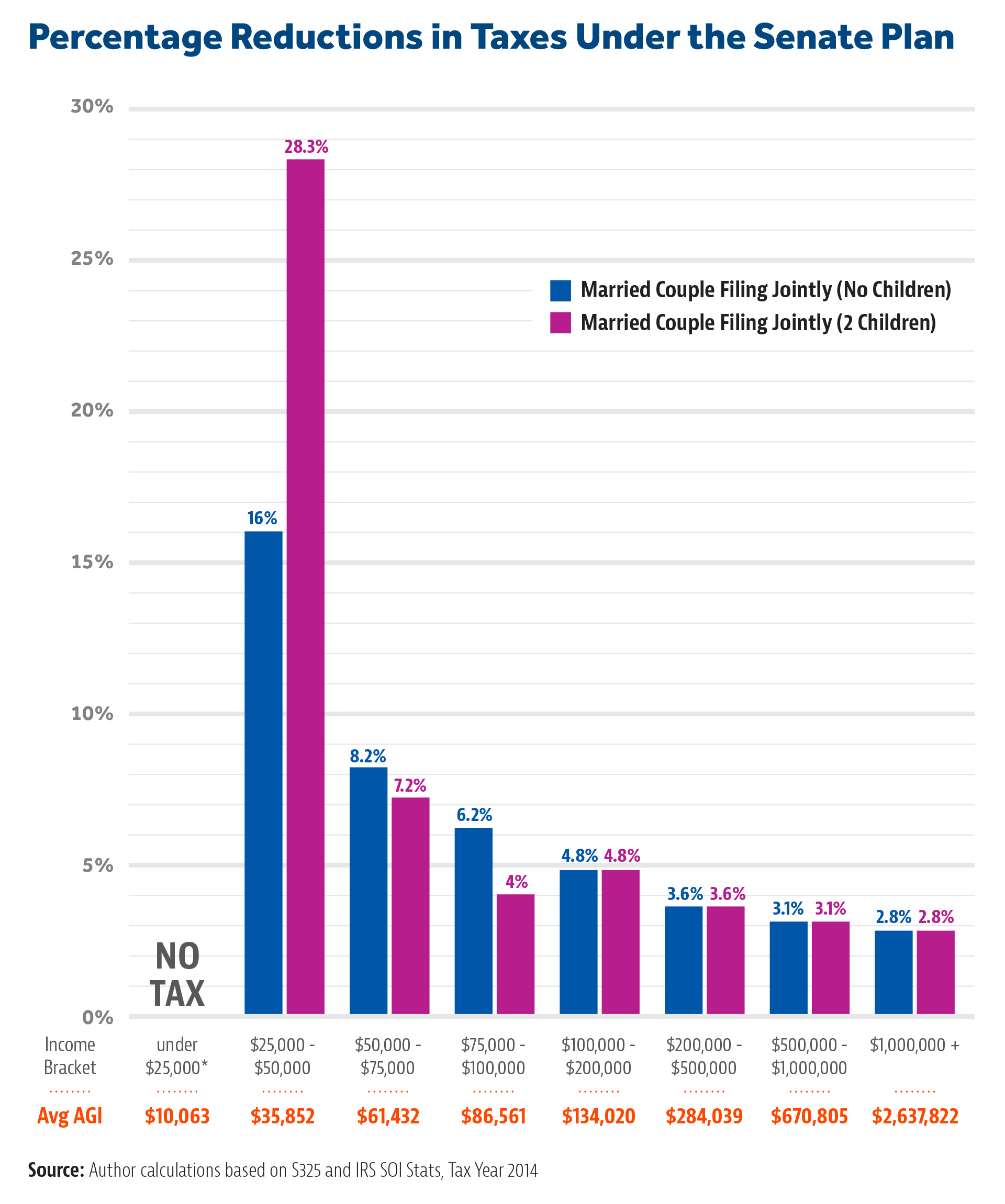

1. The plan cuts taxes by a larger percentage for taxpayers at the lower end of the income spectrum than for those at the higher end,

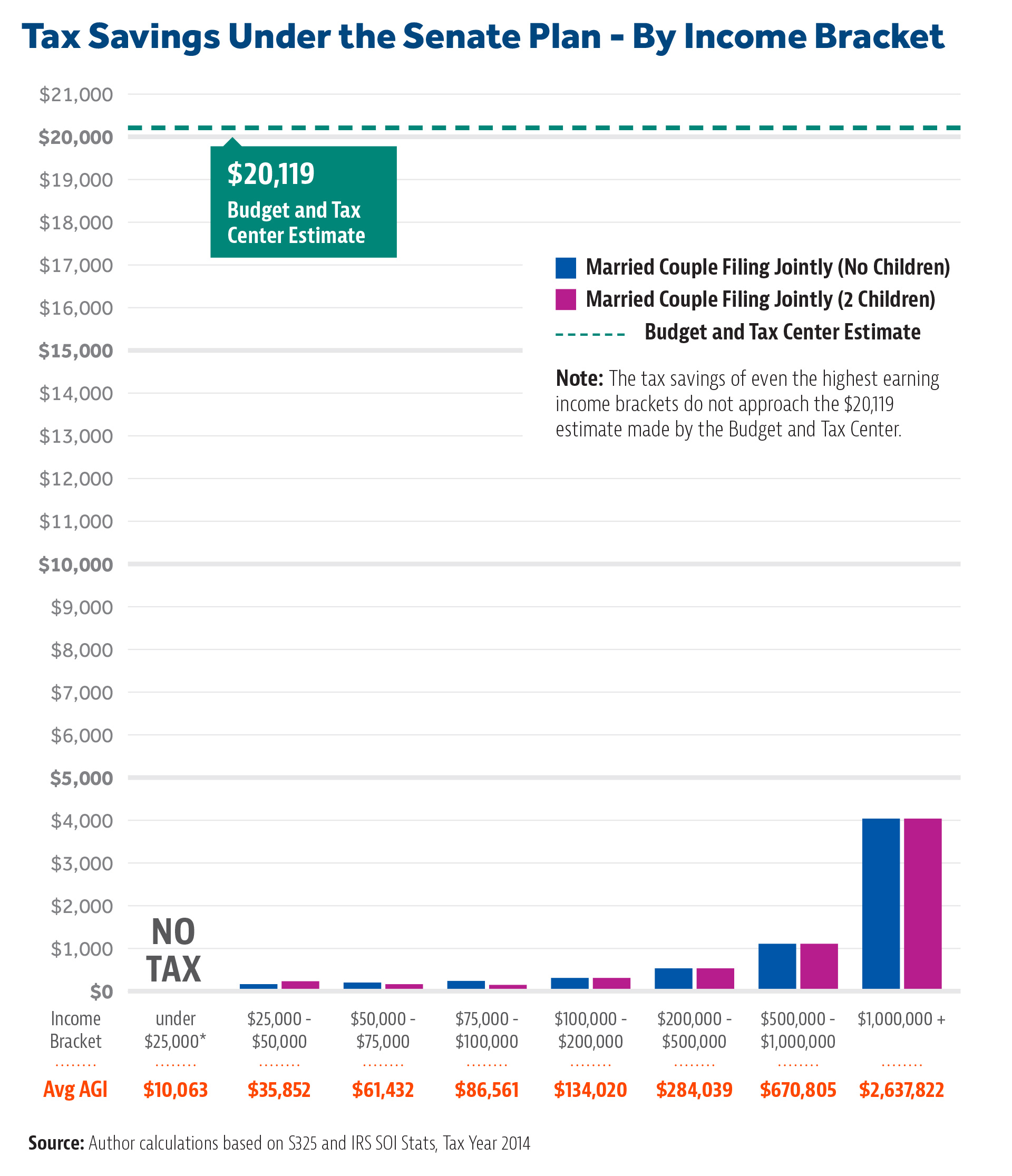

2. It does not provide $20,000 in tax relief to the average millionaire, and

3. It really does cut taxes by $1 billion over the biennium.

Expanding the standard deduction means more people will have no tax liability at all. Most people in the lowest 20 percent of income earners already paid no income tax, so they receive no benefit from the tax cut in the same way that a person without gluten allergies receives no benefit from gluten-free pizza. A married couple with two children earning $25,000 to $50,000 could save 28 percent on their tax bill. At every income level, taxpayers who are “married filing jointly” save more than those filing as “single” or “head of household.”

The plan changes income taxes for individuals and corporations. Here are the details:

Personal Income Tax

• Reduces the personal income tax rate from 5.499 percent to 5.35 percent, a 2.7 percent reduction,

• Increases the Standard Deduction from $8,750/$14,000/$17,500 to nice, round numbers: $10,000/$15,000/$20,000,

• Changes the child tax credit to a phased tax deduction that results in higher tax savings for those in the lowest income tiers, and

• Adjusts the cap on the mortgage interest and property tax deduction to a tiered deduction based on income with a maximum allowable deduction of $22,000, instead of $20,000. My back-of-the-envelope calculation suggests that, at the average property tax rate of $1.08 per $100 valuation, an owner with a 5 percent interest rate would need an average outstanding principal in excess of $325,000 over a year to exceed the $20,000 cap.

Business Tax

• Reduces corporate income tax rate from 3 percent to 2.75 percent in 2018 and 2.5 percent in 2019, and

• Institutes a flat $200 franchise tax on the first $1,000,000 of a business’ net worth and then $1.50 per $1,000 of net worth above that.

Market-Based Sourcing

• Charges multistate companies an income tax based on the amount of goods and services consumed in North Carolina, which removes a penalty for companies that locate in the state.