With Thanksgiving in hindsight, it’s that time of year again. Time to renew your health plan, that is.

The Affordable Care Act’s 2017 health insurance enrollment period has reached its midpoint, and consumers in North Carolina are facing an average 14 percent rate increase.

This comes as no surprise, considering that premiums have doubled within the past four years due to the federal health law’s costly consumer protections it imposes on private insurance companies. Yet these ‘consumer protections’ are worthless for many Americans if it means they can’t even afford insurance.

What is surprising, however, is that people who can afford their health insurance still run the risk of encountering financially ruinous medical bills.

Welcome to the world of surprise billing.

Surprise Billing – What is it?

Before diving into the issue of surprise bills, it’s important to first talk about the concept of balance billing. For certain health care services, some health plans require policyholders to pay the difference of what a provider charges an insurer and the amount the insurer pays that provider. So, to keep out-of-pocket costs as low as possible, it’s critical for policyholders to seek care by providers and health care facilities that participate in their health plan’s network. In-network providers agree to an insurer’s reimbursement contract.

Balance billing, however, can end up blindsiding patients when they are unexpectedly billed by an out-of-network provider. Hence the term surprise billing.

The conflict isn’t all that uncommon for emergency care. Even when a patient makes sure to go to an in-network Emergency Room, there’s no guarantee that the attending health care providers are also in-network. One in five health claims for emergency services are submitted by out-of- network providers, reports the New England Journal of Medicine. This is because many emergency physician groups aren’t employed by hospitals. As independent contractors who work at multiple facilities, they negotiate insurance payment separately.

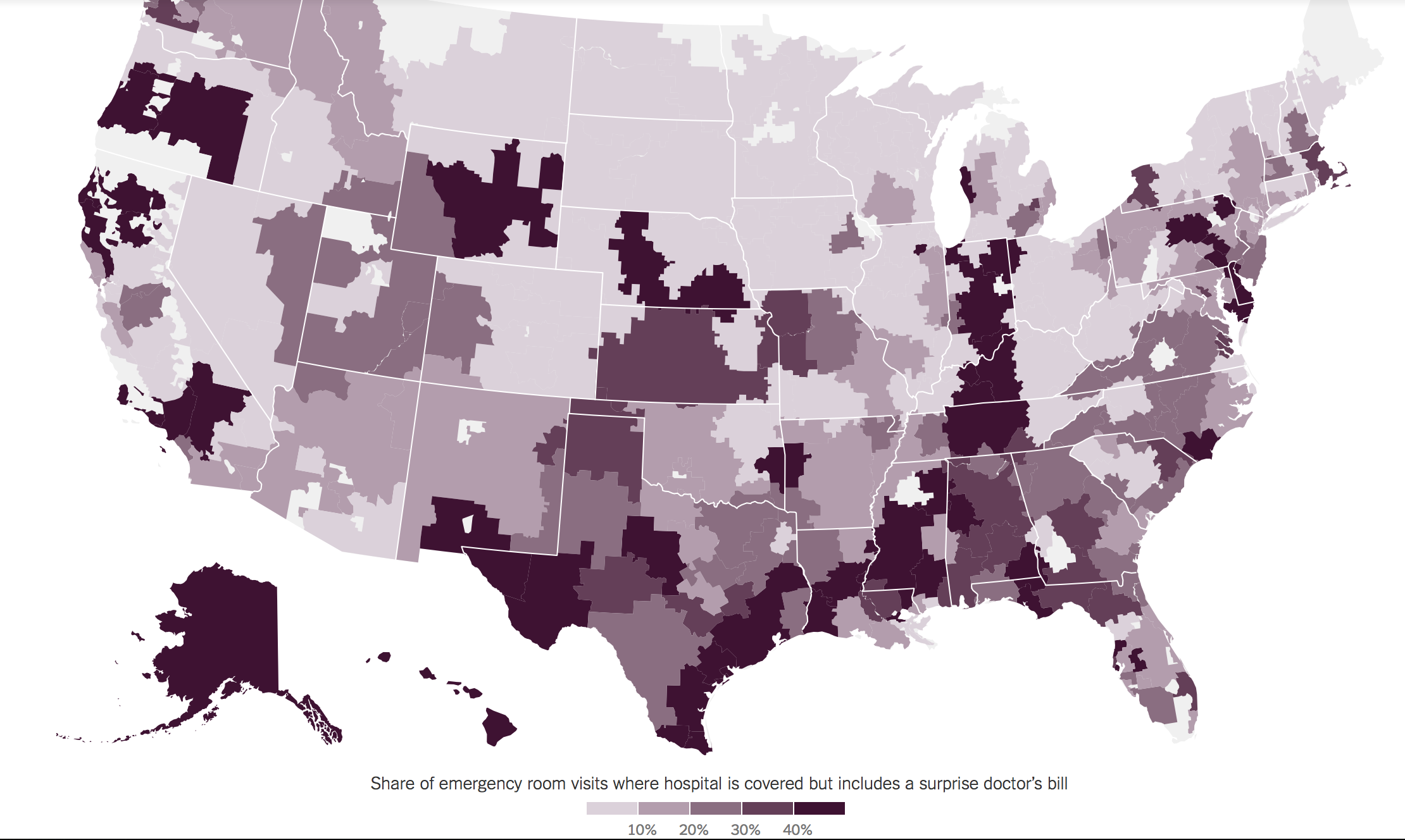

The map below lays out where patients across the country are more likely to receive a surprise bill for emergency care when presenting themselves at an in-network facility. In North Carolina, these encounters are much more prevalent throughout the southeastern region of the state. In Columbus County, for example, out-of-network emergency physician groups have charge rates as high as 1015% of what Medicare pays.

Source: The New York Times

Source: The New York Times

The ER isn’t the only point of entry in the health care system where patients can be exposed to surprise bills. It can also happen after elective surgery. Say, for example, a patient schedules to have their knee replaced. The patient is informed that the surgeon and the hospital are in-network, but has no idea the anesthesiologist isn’t. A few weeks later, the patient is hit with a medical bill for anesthesia at a surprisingly high out-of-network rate. Like emergency physicians, anesthesiologists may also be out-of-network if they aren’t salaried by any hospital.

For more stories on surprise billing and what states are doing to temper the situation, click here, here, and here.