North Carolina lawmakers cut taxes in the last biennium budget, lowering the dollar amount workers owe to the state. During the current long session, we may see additional tax changes. There are numerous ways to change the taxes you owe, and it is important to understand the differences and how they might affect you.

What is the difference, for example, between a tax cut and a tax rebate? What about a tax exemption? Or a tax holiday?

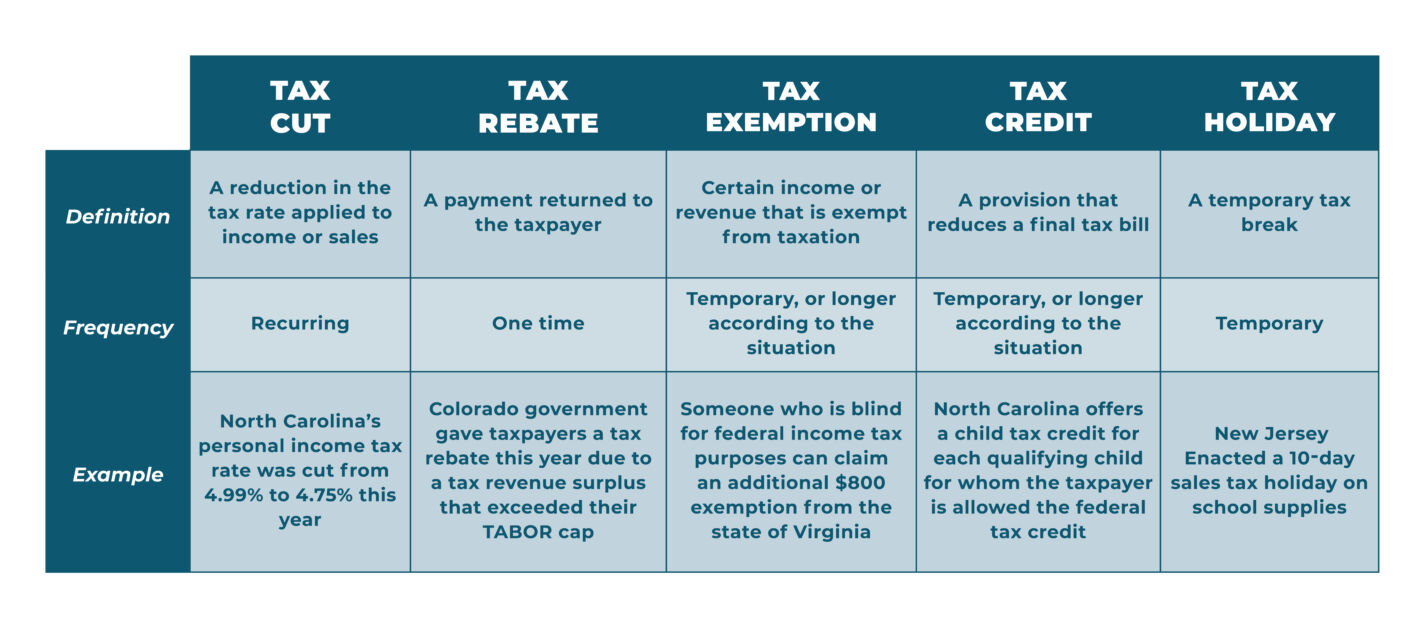

See the below chart for a snapshot of the important differences:

A tax rate cut reduces the amount of taxable income you owe to the government. Tax rate cuts are typically recurring, remaining in place until lawmakers choose to raise rates later. A notable exception to this was the state’s “temporary” tax hikes in the Great Recession, which originally came with a sunset date. North Carolina has seen recent cuts to our personal income and corporate income tax rates. This is important because you earned that money. Ultimately, your money should belong to you. The taxes we pay should go to fund the core functions of government. Smaller government should mean a smaller tax burden on workers.

A tax rebate, on the other hand, is the government returning money to you that it already collected. Generally, this occurs when the government takes more taxes than it should have. A tax rebate still lets you keep more of your money, a net positive. A tax cut is better, however, because it happens every year, not just in the surplus years, and allows you to keep your money all along, rather than send it to the government in the hopes of receiving some of it back.

A tax exemption generally depends on your unique situation. Some entities themselves are tax-exempt, so long as they meet the requirements under Section 501(c) of the tax code. Personal tax exemptions also exist. The standard deduction is an exemption of the personal income tax up to a certain dollar amount. In North Carolina, our standard deduction has been dramatically increased, meaning more (or all) of your income is tax-free.

A tax credit is a provision that reduces a taxpayer’s final tax bill. This is different from a tax exemption which reduces taxable income. Tax credits may be recurring, depending on your situation. North Carolina’s child tax credit, for example, is recurring as long as the taxpayer has eligible children. The structure of this credit is progressive, because it represents a larger share of the lowest taxable households’ income.

A tax holiday is essentially a temporary tax cut, and usually applies to the sales tax. Recent discussions on tax holidays often center around providing inflation relief. Nationwide price spikes encourage some states to consider gas tax or grocery sales tax holidays. Though this does save taxpayers money, it also temporarily reduces the tax base. A broad-based tax cut would be more beneficial to taxpayers than removing certain items from the base.