Joseph Henchman of the Tax Foundation offers the case for celebration.

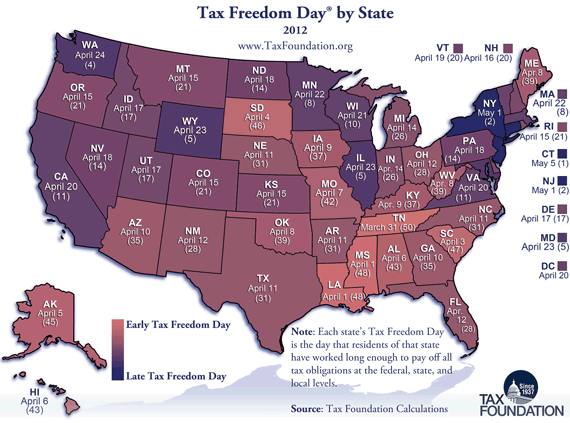

The total tax burden borne by residents of different states varies considerably, not only due to differing state tax policies, but also because of the steep progressivity of the federal tax system. This means higher-income states celebrate Tax Freedom Day later: Connecticut (May 5), New Jersey (May 1), and New York (May 1) residents face a significantly higher total federal tax burden than lower-income states.

Residents of Tennessee will bear the lowest average tax burden in 2012, with Tax Freedom Day arriving for them on March 31. Also early are Louisiana (April 1), Mississippi (April 1), South Carolina (April 3), and South Dakota (April 4).

Among our neighboring states, only Virginia (April 20) has a later Tax Freedom Day.