The state General Assembly comes back in session on September 2. One of the most important things on the docket is to draft a budget for the upcoming years as well as appropriate the remaining monies from the $4 billion awarded to the state in Coronavirus Relief Funds. JLF’s Joe Coletti explains the multifaceted budget situation that the General Assembly is facing:

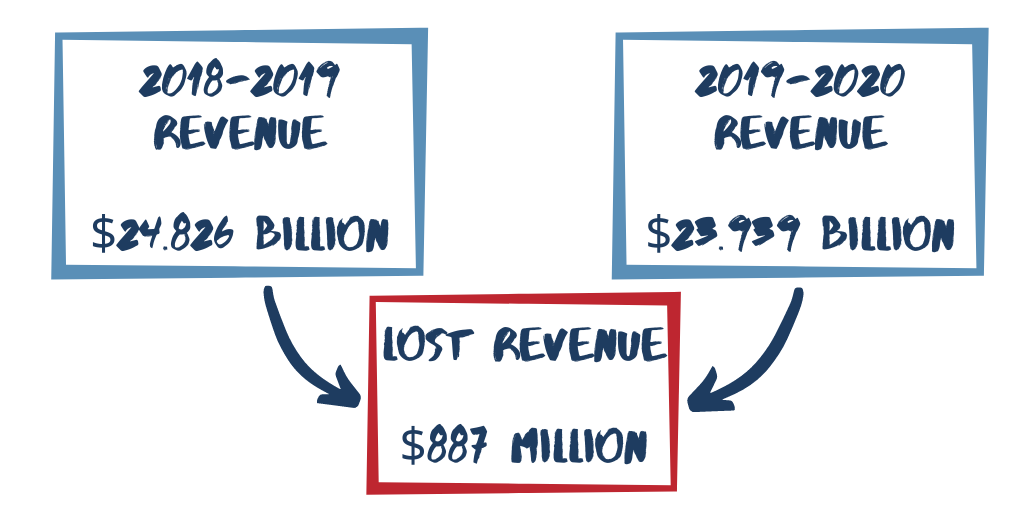

Total revenue for Fiscal Year (FY) 2019-20 fell $887 million from the previous year’s $24.826 billion to $23.939 billion… A looming question is whether nearly $900 million of the $4 billion from the Coronavirus Relief Fund (CRF) can be used to offset [these] lost revenues.

This lost revenue comes predominantly from two sources. First, the tax filing extension. Coletti writes:

A significant portion of the loss is due to the extended deadline for personal and corporate income tax filing. Final payments that would have been made in April were delayed until July 15 and a new fiscal year. This change pulled the year-end total down to $12.415 billion, which was $752 million (6%) less than FY 2018-19

In addition to millions of tax dollars coming in late, a reduction in the corporate income tax played a role. Coletti explains:

At $658 million, corporate income tax revenue was down $173 million (21%) from FY 2018-19 and $78 million (11%) less than budgeted. That $95 million difference makes it seem clear the corporate income tax rate reduction from 3.0% to 2.5% played a significant role in lower revenues.

What’s more, the state is facing increased expenditures – mainly from education, Medicaid, and public safety costs. Coletti writes:

Even as revenues fell compared with FY 2018-19, state expenditures increased… Education, Medicaid, and public safety were the largest areas of spending as well as the drivers of growth. Combined, they [were] $497 million (2%) higher than in FY 2018-19.

All in all, North Carolina is facing fewer revenues and heightened expenditure, all of which the General Assembly will have to tackle in the upcoming session. Using CFR funds could help fill in the gaps, but it is still unclear whether or not that will be an option. Several factors add even more complexity to the equation. Coletti explains:

Among other issues they will address are whether to appropriate matching funds for higher unemployment benefits, what should be the right level of state funding for universities that have moved classes online for the year, and how to provide greater access to broadband for families with younger students.

Read Coletti’s full brief here. See his recommendations on how North Carolina can fiscally rebound from the COVID-19 outbreak in Carolina Rebound, the John Locke Foundation’s game plan for reviving our state’s economy, here.