Elections have consequences. That’s what the people of Guilford County are finding out as the County Board of Commissioners recently approved an $861 million budget, which will raise property taxes by $418 on average.

This increase is likely due in part to voter approval of a massive $1.7 billion in school bonds during the primaries on May 17.

The Greensboro News & Record reported: “By a vote of 6-3 along party lines, the board approved the fiscal year 2022-23 budget with a tax rate of 73.05 cents per $100 of taxable value. The revenue neutral tax rate—where the board would raise the same about of money as in fiscal year 2021-22—would have been 59.54 cents.

“For the average median home valued at $241,750, the property tax bill would increase by $418 under the current tax rate when compared with the revenue-neutral rate.”

There will also be a “fraction of a penny (0.25%) sales and use tax that will help finance the bond,” though it does exclude gas, prescriptions and groceries.

As the country spirals towards recession, this news isn’t good for the people of Guilford County.

For most voters, this issue probably sounded like a great idea at the time. Education has become a key factor for many parents and families as they vote, and schools can be in desperate need of funding and support.

But nothing is free, and these bonds may prove more burdensome than the people of Guilford County initially anticipated.

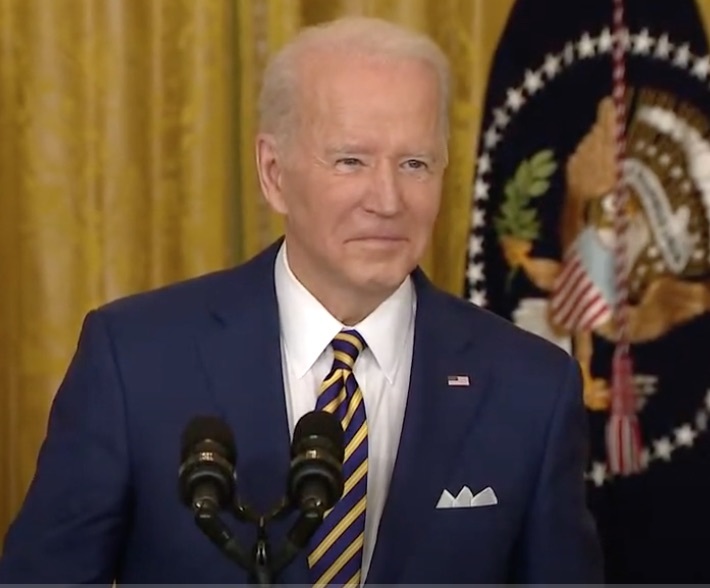

Terry Stoops, Director of the Center for Effective Education at the John Locke Foundation, explains: “Once Guilford County begins selling the approved bonds, taxpayers will be crushed by property tax increases required to pay the principal and interest on the debt. Given that the Biden economy continues to wreak havoc on family budgets, Guilford County’s decision to spend billions on new and renovated schools is a declaration of war against low- and middle-income taxpayers.”

This $1.7 billion bond will cover “safety and technology upgrades for all schools as well as major repairs for failing roofs, HVAC, and plumbing,” the rebuilding 18 schools, renovating an additional 13 and constructing 3 new schools.

So, Guilford County must be experiencing an influx of students, right?

Well, no. In fact, there has been a 7.2% decrease in the student population over the last decade, as reported by Stoops.

2020-21: 66,420

2011-12: 71,587

It seems like Guilford County is hedging on the mantra, “If you build it, they will come.” But if that isn’t the case, families are seeing their property taxes being raised during a recession by potentially several hundred dollars for state-of-the-art school facilities for a dwindling student population.

Children will benefit from some of these improvements, but it also seems like a cash grab for the county, which then unnecessarily burdens the taxpayers as the country is experiencing inflation, a recession and an uncertain economic future.

Other counties may try similar measures as well.

“County and school district officials likely see the support of the Guilford school bond as indicative of taxpayers’ appetite for approving massive borrowing for school buildings. I would not be surprised to see other large, urban counties enthusiastically follow suit,” Stoops said.

For more, check out the Center for Effective Education here.