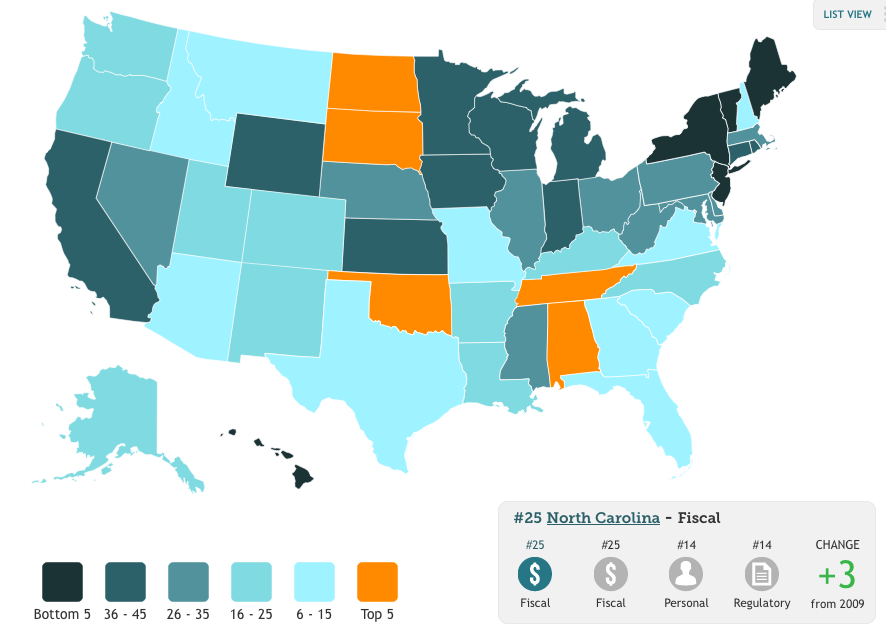

North Carolina is ranked 25th in the Nation in Fiscal Freedom according to the Mercatus Center’s Freedom in the 50 States. Fiscal Freedom includes: taxes, government employment, spending, debt, and fiscal decentralization in this ranking. So why are we 25th? According to the study, North Carolina’s taxes have been consistently close to the national average over the past decade (at 9.2 percent of income in FY 2010), while government consumption plus subsidies and employment rankings are slightly worse (higher) than average, and North Carolina’s debt is significantly better (lower) than average. Still, we must remember that in looking at average numbers, there are outliers that skew the data, such as New York and California – so being close to average isn’t that great overall.

North Carolina has some work to do in its fiscal freedom. Neighboring Tennessee is ranked #2 in fiscal freedom, one of the obvious reasons legislators have used Tennessee as a comparison when debating tax and business legislation. Alabama is also in the Southeastern region at #5 in most fiscally free. Who are the least free? That might not come as a surprise, the least fiscally free states are New York at #50, Hawaii at #49 and New Jersey at #48. Thankfully none of these states have ever been used as a model when considering fiscal policy in North Carolina.