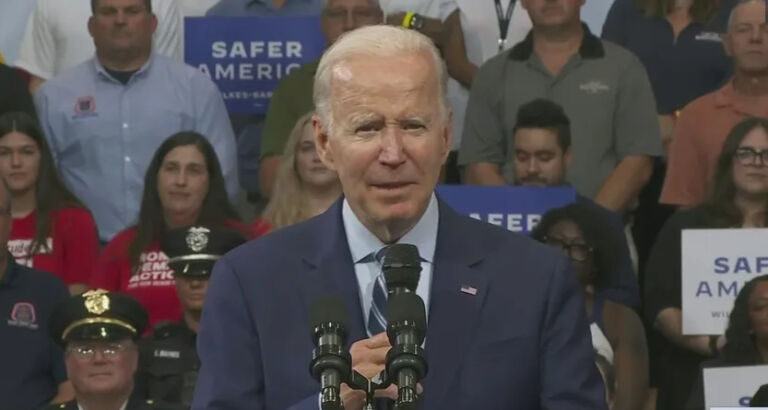

Last night in the State of the State address, McCrory laid out some of his plans for the upcoming legislative session. Not surprising, he suggested issuing bonds to pay for transportation and he elaborated on his previously stated objectives of improving outdated state infrastructure. What needs to be addressed is if these requests are realistic. Lets focus on the debt portion of his speech (especially relevant since the Treasurer’s Debt Affordability Statement was released Monday).

- Approve $1.2 billion in bonds to “jump-start” transportation projects.

- Approve a $1.2 billion to $1.4 billion general bond proposal to renovate “crumbling” buildings or to tear down buildings that cannot be saved.

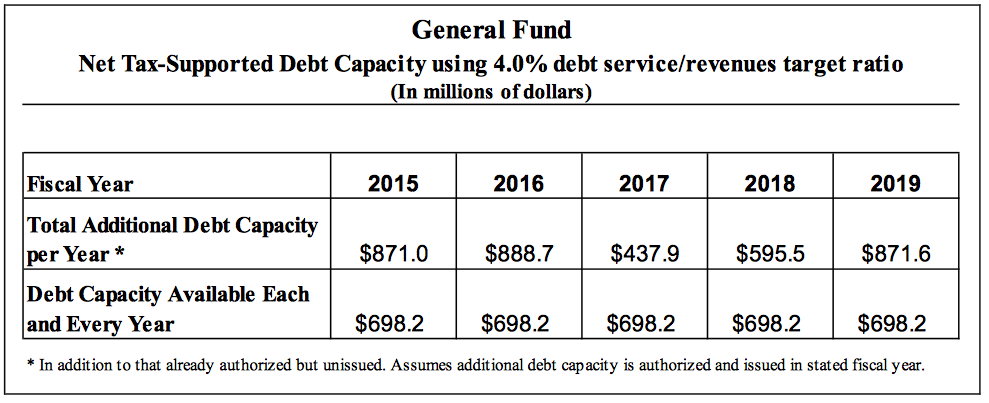

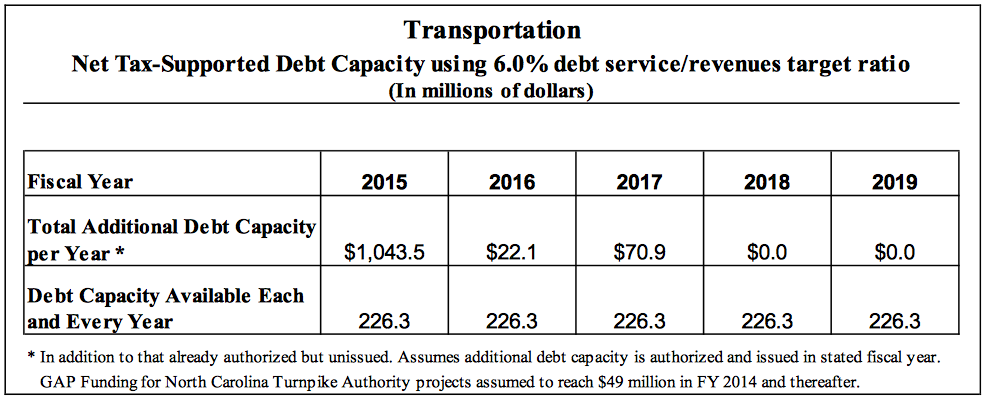

While I agree with the Governor that roads and bridges need to be improved across the state and there are multiple state buildings that are not safe for state employees – his method of payment might not be as easy as he might think. According to the State Treasurer, the General Fund (which manages agency buildings) has nearly $700 million available in debt capacity in each of the next 10 years. For Transportation, the state’s debt capacity is approximately $1.044 billion in the current fiscal year and totals approximately $1.136 billion through 2019. Evenly distributed by each year, Transportation has the capacity to issue $226 million each year in the near future.

Interest rates are at historic lows right now, so the idea of issuing General Obligation bonds is an inexpensive way to fix state infrastructure and roads – the concern is the amount he is talking about. As evidenced from the treasurer’s report, the state does not have the debt capacity to issue $2.6 billion in debt this year. An easy solution is to spread the debt out over time, which sounds like a logical and practical solution – one problem with that. Most industry analysts have predicted interest rates will more than likely increase before the end of this calendar year and most definitely in 2016. Which means, the more time we take to issue the debt – the more it will cost the state in debt service because the interest rates will be higher.

And has anyone thought what North Carolina would do in a state of emergency or another recession? Maybe we need to have a little debt availability set aside for an unexpected cost and not use it all up now…..just a thought.