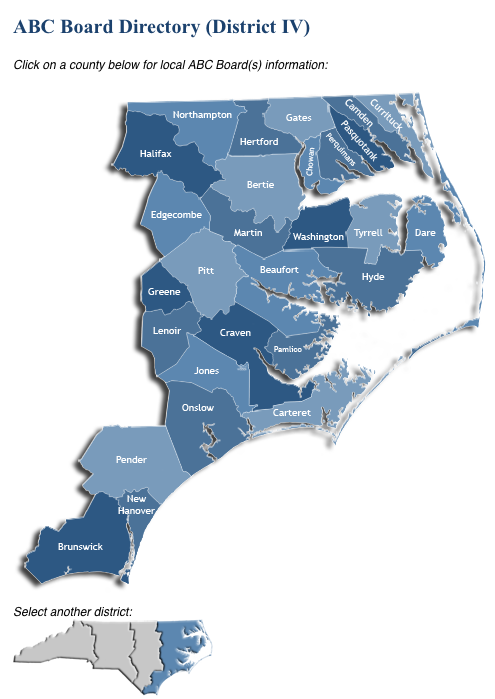

Even though the State oversees ABC stores and there is a state and federal excise tax placed on liquors, each county distributes the profits from those sales differently from each other. The state is divided into 4 districts, each of which are found on the ABC Board Directory. Below are three neighboring counties from the 4th District; here you can see how different each county distributes their profits from ABC sales.

Pender County:

| Gross Profits: |

- Law Enforcement – 5% to 15%

- Alcohol Education – 2% to 5%

- 5% to Mosquito Control

|

| Net Profits: |

- 65% to Pender County General Fund

- 35% to municipalities in which stores are located based on sales

|

Onslow County:

| Net Profits: |

- 5% to Jacksonville General Fund

- 4% to Richlands General Fund

- 4% to Swansboro General Fund

- 3% to Holly Ridge General Fund

- 5% to each municipality with a store

- 10% to Onslow County Hospital

- Remainder to Onslow County General Fund

|

New Hanover:

| Net Profits: |

- 75% of store profits of Wrightsville Beach to town General Fund

- 25% of store profits of Wrightsville Beach to New Hanover County General Fund

- 75% of store profits of Carolina Beach to town general fund

- 25% of store profits of Carolina Beach to New Hanover County general fund

- 50% of city store profits to respective city general funds

- 50% of city store profits to New Hanover County General Fund

- 100% of county store profits to New Hanover County General Fund

|