The Consumer Price Index (CPI) rose 0.5% in January after falling 0.1% in December, according to the latest release from the Bureau of Labor Statistics. On an annual basis, prices have increased 6.4%.

Though the annual rate of inflation is cooling, it’s important to note that we are comparing to last January’s elevated baseline. The January 2022 CPI report showed an annual increase of 7.5%, so this year’s 6.4% inflation is on top of that already elevated price level. This month’s report shows that overall inflation, especially core inflation, is stable.

Core inflation, which excludes volatile energy and food prices, rose 0.4% over the month and 5.6% on an annual basis. Shelter prices drove the increase in core inflation, according to the release which reads, “the shelter index was the dominant factor in the monthly increase in the index for all items less food and energy.”

Food prices continue to rise. This is especially devastating for low-income families who spend a greater share of their income on food. Groceries are up 11.3% on an annual basis, while food away from home is up 8.2%.

The gasoline index increased 2.4% over the month, after two consecutive months of decreases. Since February 2021, however, gas prices have increased nearly 40%, from a $2.50 per gallon average to a $3.50 per gallon average today. The overall energy index rose 2.0% over the month after two consecutive monthly decreases.

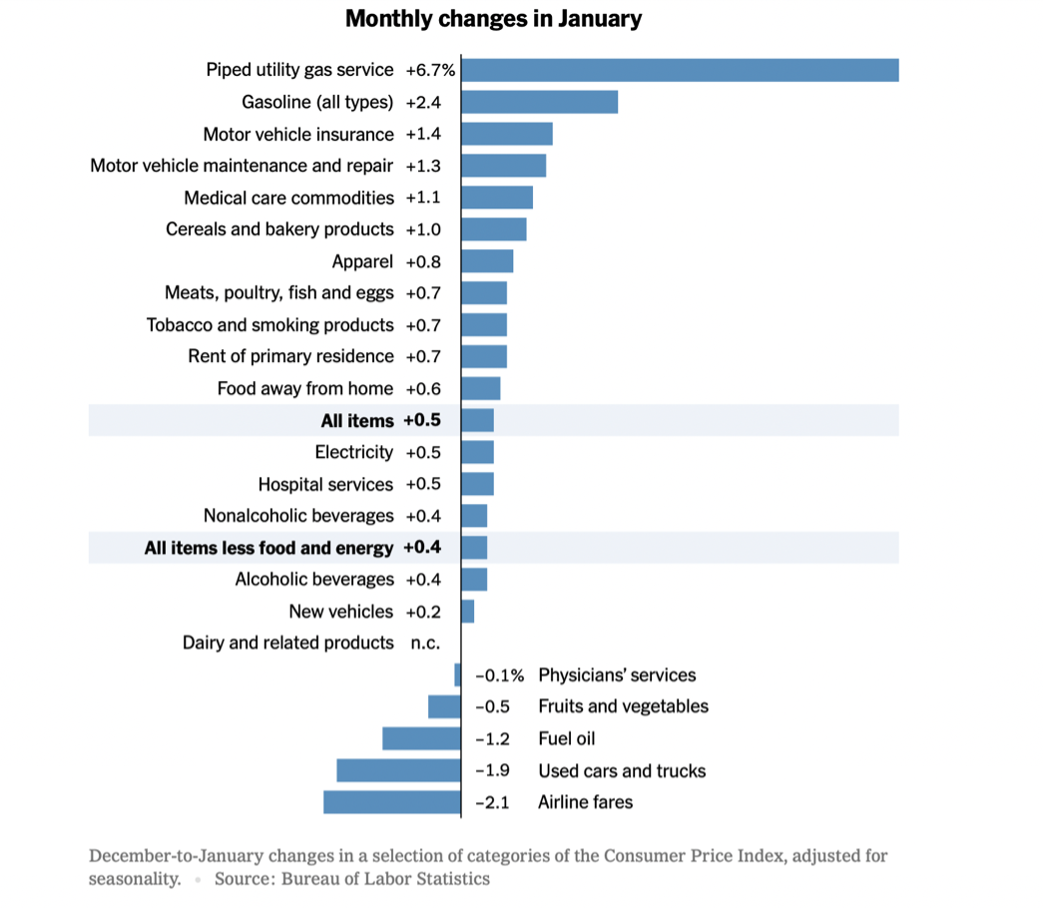

See the helpful graph below from The New York Times, which illustrates monthly changes in January for various categories:

President Biden’s Council of Economic Advisers chair acknowledged inflation remains “too high” but waved off any signs of economic downturn saying, “by a number of measures families are doing better financially than before the pandemic.” This is simply false.

The reality is that families are hurting from the Biden Administration’s reckless economic agenda and spending. CPI’s annual rate has been 5.0% or more since May 2021. Current inflation is still at heights not seen in more than 40 years. Family budgets are strained and household debt is on the rise, and the personal savings rate since September has only been lower in one month since the Fed started tracking the rate in 1959. The average mortgage payment is now 28% higher than one year ago.

Inflation comes from deficit spending fueled by money printing. Newly created money from the federal reserve has resulted in too many dollars chasing too few goods in our economy. Inflation has increased 14.4% since President Biden took office.

As a result, American families are poorer today than before Biden took office. Real average hourly earnings decreased 0.2% over the month and 0.9% over the year (seasonally adjusted), according to the Bureau of Labor Statistics. This marked 22 straight months of real wages falling.

While workers struggle to make ends meet, take up second and third jobs, and pay more for the same goods and services, the Biden Administration shows no sign of fiscal restraint.