As the COVID-19 pandemic took hold in the United States, millions lost their jobs due to government-mandated shutdowns and plummeting demand for certain goods and services. Tragically, this massive job loss meant that many of those who lost their job also lost their employer-sponsored health insurance (ESI).

ESI has been a core piece of the American health insurance system since World War II. While this arrangement allows businesses to compete for labor by offering generous health plans, changes in employment happen much more often than changes in an employee’s need for health care. Due to this arrangement, changing jobs or unemployment due to a recession leads to individuals losing their health insurance. While a pandemic of this nature is undoubtedly going to be a relatively rare event, too many people fall victim to a system that ties health insurance to employment.

Those who don’t get health insurance through their employer are either on a public insurance program, purchase insurance through the individual market, or are uninsured. The topic of this research brief will be the individual health insurance market and how our state can make it more functional for those who don’t get their insurance through their employer or who are uninsured.

Section 1332 of the Affordable Care Act (ACA) is a provision that allows the states to waive federal regulations on the state individual health insurance markets and employ state innovations to provide health insurance to those who don’t have ESI. The Trump administration significantly relaxed the requirements states must meet to be granted a 1332 waiver to restructure their health insurance markets. A 1332 waiver would better serve North Carolina than to expand government-centered proposals like Medicaid expansion.

Medicaid Expansion vs. 1332 Waiver

It’s a tragedy how many individuals have lost their ESI due to the fallout from the coronavirus. This has led many to ask about the policies available to increase insurance coverage. Naturally, Democratic members of the General Assembly and liberal advocacy groups prefer a government-centered solution to health care, as opposed to creating a more functioning health care market for those who are uninsured. A government-centered solution to this issue is to expand Medicaid, the program for low-income children and mothers, the elderly, the blind, and the disabled. Medicaid expansion would add able-bodied, working-age adults to the list. This is a classic example of how the welfare state has grown so large in our country: a program serves a particular population later expanded as politicians deem new populations worthy of certain benefits.

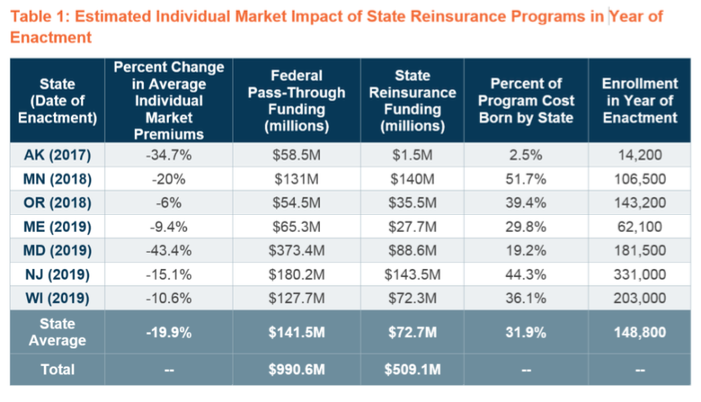

However, a solution exists that does not involve a massive expansion of government. Through a provision in the ACA, Section 1332, states are allowed to apply to waive certain federal health regulations to try innovative state base solutions for creating a more functioning health care market. Several states have successfully applied for a section 1332 waiver. Most states which have applied for a waiver set up a reinsurance program in the state. Table 1 shows the changes in premiums in the individual markets of each state.

North Carolina could achieve these premiums reductions for its individual market with a sound reinsurance program. The reinsurance fund would pay claims over a certain amount. With reinsurance to cover these high-cost claims, insurance companies could reduce premiums across the board. Newly affordable health insurance plans could help those who are currently uninsured and draw individuals who had previously left the marketplace because of costs. Higher enrollment in the individual market could bring in lower-risk people with less need for insurance, which would further reduce premiums.

Compared to Medicaid expansion, reinsurance programs or other 1332 innovations would be significantly cheaper to the state and could have a far greater impact on coverage. On the cost side, instead of spending new state and federal dollars, the latter of which increases the federal deficit, the state could restructure federal dollars already slated to come in the state to lower insurance premiums for everyone who may get insurance in the individual market. The state would need to contribute a portion of the cost. Yet it is much lower than the estimated $400 million a year Medicaid expansion would cost the state.

On the coverage side, the individual marketplace in North Carolina already saw a decline in enrollment starting in 2016. Many of these individuals were at the higher end of the income spectrum and dropped their coverage due to the cost. Lowering premiums would likely draw them back and would give individuals at the lower end of the income spectrum affordable private insurance options.

But state reinsurance programs are not the only reforms that could come out of a 1332 waiver. The current administration provided new guidance for states shortly after taking office, which increased opportunities for experimentation. To be considered for a 1332 waiver, state waivers would need to:

- Provide access to quality health care that is at least as comprehensive and affordable as would be provided without a waiver

- Provide coverage to at least a comparable number of residents of the state as would be provided coverage without a waiver

- Not increase the federal deficit

Moving Forward with a 1332 Waiver

It’s worth remembering the section 1332 is the embodiment of a decentralized health care market that conservatives have been calling for since the ACA failed to achieve its goals of lowering health care costs and providing universal coverage. Since states have the authority to regulate their insurance markets, states should be able to direct federal money that is already appropriated to lower costs and expand coverage for the state. No two states are the same, so no two insurance markets should operate under the same rules and regulations.

North Carolina lawmakers interested in a serious reform that benefits those who do not get their insurance from their employer should look to a 1332 waiver and embrace state innovations. To get this process started, the NCGA would need to pass enabling legislation that would direct the Department of Insurance to create an application for the 1332 waiver. The Centers for Medicare and Medicaid Services has provided a checklist of state duties that need to be completed for the federal government to approve the waiver.

The coronavirus’s effects on the unemployment numbers (and by default, the number of insured individuals through their employer) will be long-lasting. State budgets will be stretched as far as possible until there is some recovery in tax revenues. This means that any health care reform needs to focus on covering as many individuals at the lowest cost possible. Medicaid expansion fails to accomplish both of these goals. A successful section 1332 waiver can achieve both. Lawmakers can get this process started by working with the Department of Insurance to get the work underway for submitting a 1332 waiver.

Whether that waiver ends up creating a state-based reinsurance program or another innovative state design, this reform will produce more affordable coverage options for those who don’t get insurance from their employers or are uninsured. It is the correct policy decision at a time when North Carolinians continue to struggle with the economic effects of COVID-19.