Under Obamacare, insurers are required to cover more benefits, can’t deny coverage for a policyholder’s pre-existing condition, and are prohibited from accurately pricing people’s risk based on their health status. They also can’t charge older policyholders’ premiums more than three times the amount of a young person’s premium.

All these consumer protections come with a hefty price tag, which explains why policyholders are experiencing multiple rounds of double-digit premium increases over the past four years.

What’s an insurance company to do?

The Rise of Narrow Networks

Many are responding by designing narrow networks to control costs. Obamacare may have taken away most strategies insurers typically use to keep premiums and out-of-pocket expenses in check, but insurers still have the freedom to build plans that feature fewer provider choices.

Almost half of Obamacare plans feature both small and extra small hospital networks. Small networks cover less than 70 percent of local hospitals, while extra small networks give policyholders access to fewer than 30 percent of local hospitals. Policyholders are feeling the squeeze in the western part of North Carolina, as Mission Health has failed to renew its contract with Blue Cross and Blue Shield.

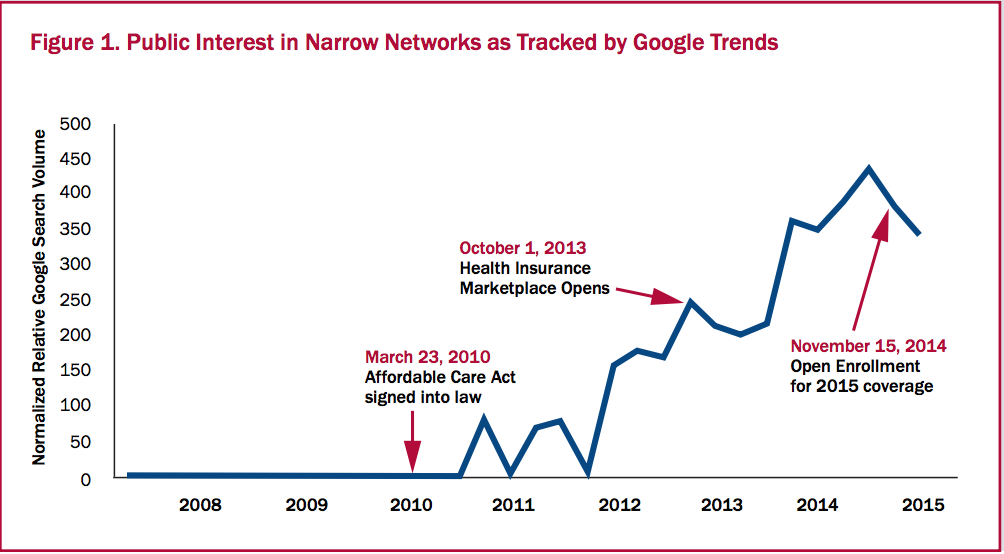

However, some people prefer narrow networks. Price-sensitive consumers are willing to sacrifice fewer health care options in exchange for lower premiums and cost-sharing. These plans are also popular for people who don’t use the health care system often. The chart below shows that, even before the federal health law’s exchanges were first implemented in 2014, an increasing number of people expressed interest in narrow network options.

Source: Leonard Davis Institute of Health Economics, Robert Wood Johnson Foundation

But a higher prevalence of narrow networks will likely produce more surprise medical bills.

Read more about surprise medical billing here, and learn how a free-market, price transparent-loving surgery center is solving the issue.