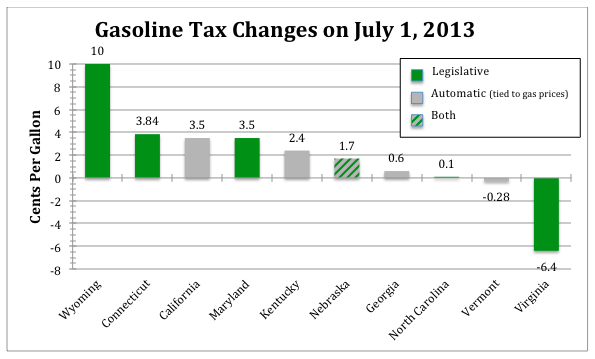

July 1 is the beginning of many states’ fiscal year, and also the first day for many new taxes to take effect. This year has been the year of tax legislation, both cutting taxes and increasing taxes. Today, eight states raised their gasoline tax rates, Wyoming and Maryland passed legislation this year implementing increases, while Connecticut’s increase is due to legislation passed in 2005. California, Kentucky, Georgia and North Carolina’s rate increases are tied to an automatic adjustment based on gas price increases and decreases. Nebraska is a unique situation as their price is rising due to both an automatic adjustment tied to transportation spending by the legislature along with an increase in gas prices.

Unfortunately there are fewer states that will see gasoline taxes fall today. Virginia is the most notable with a drop of 6.4¢ per gallon thanks to a legislative change. Vermont will see approximately a quarter of a cent decrease due to a drop in gasoline prices. Although not included in this chart, the green mountain state instituted an almost 6-cent hike that went into effect in May as a result of new legislation.