This year Gov. Roy Cooper vetoed the state budget, and the first reason he gave for doing so was that it included a corporate tax cut.

Specifically, it would have cut the franchise tax. That’s an unusual and outdated tax, and only 15 other states still have it. The franchise tax amounts to a double tax on corporate assets, not corporate income, and it lets North Carolina tax their business expenditures, even on things like capital and equipment that would be fully deductible under the corporate income tax.

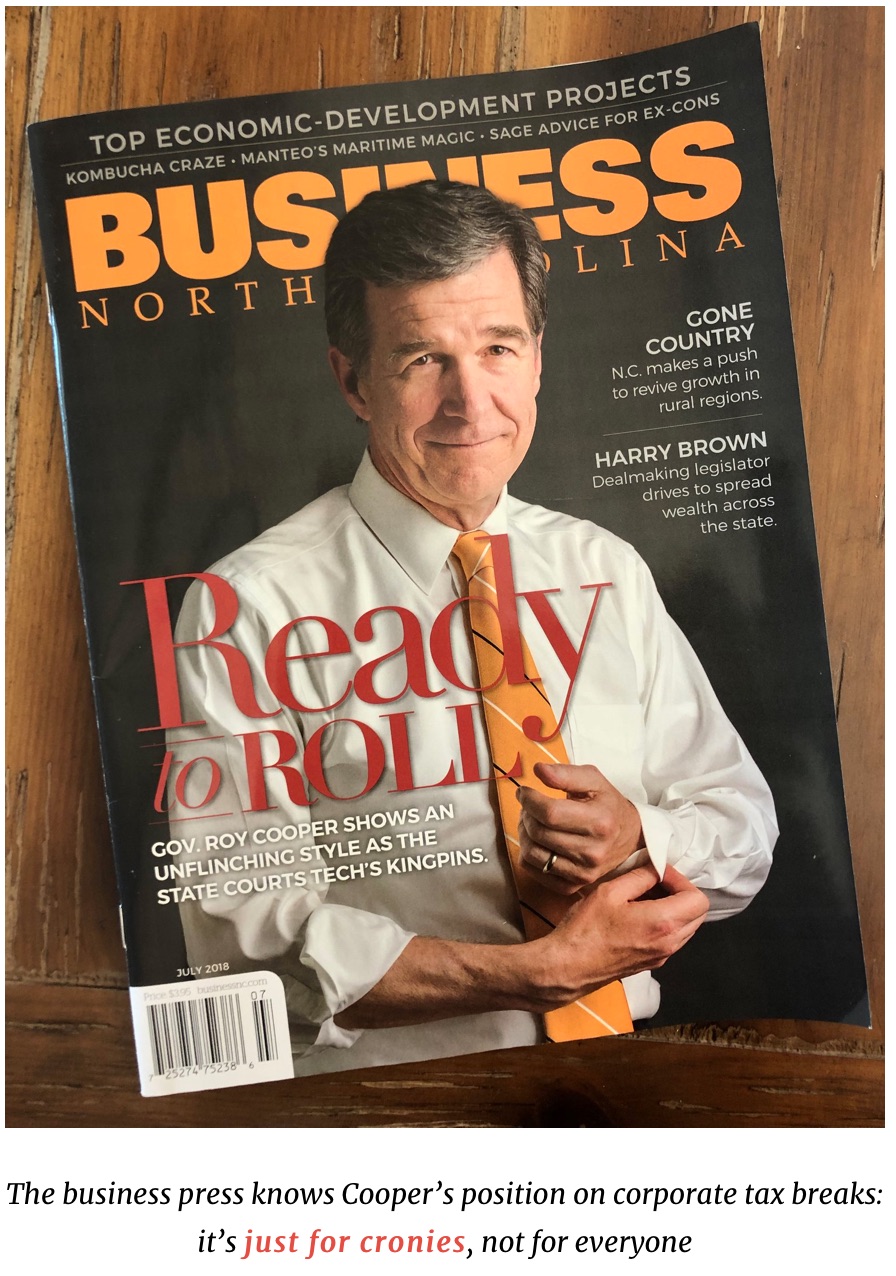

Cooper made it sound as if this tax cut prevented higher teacher pay raises than what were in the budget. “It values corporate tax breaks over classrooms,” he said, later adding, “Instead of another corporate tax break, let’s pay our teachers and show them the respect they deserve.”

For this purpose, it doesn’t matter that Cooper’s portrayal isn’t how budgeting actually works. What matters here is that Cooper believes it is (or thinks you will).

The franchise tax cut would have let North Carolina companies, from big corporations down to small Mom & Pop shops, keep $252.2 million in 2020-21.

My question:

If Cooper thinks letting corporations keep $252.2 million is taking money from teacher raises, then why did he give corporations $146 million in state money last year?

It’s not that he did that quietly. Cooper’s press office makes an announcement every time his administration approves another Jobs Development Investment Grant (JDIG) or One North Carolina (OneNC) grant to a corporation. The sum of all those grants Cooper announced in 2019 is $145,967,890.

In fact, Cooper announced $72.9 million in corporate giveaways after vetoing the budget supposedly for corporate tax breaks.

In November, Cooper vetoed a standalone bill with the franchise tax cut. Oddly, he also vetoed a standalone teacher pay increase.

Since that day, Cooper — who would have media, teachers, and you believe that money not taken from corporations is one-to-one money not given to teachers — has approved the following grants of state money to corporations:

- Nov. 12: announced $1.7 million to Pamlico Yachtworks

- Nov. 19: announced $3.4 million to Well Dot, Inc.

- Nov. 25: announced $500,000 to the Fresh Market

- Nov. 26: announced $75,000 to Polyhose Inc.

- Nov. 27: announced $9.6 million to Q2 Solutions

- Dec. 3: announced $1.4 million to Little Leaf Farms, LLC.

- Dec. 4: announced $200,000 to Merck

- Dec. 5: announced $100,000 to Sunlight Batteries USA

- Dec. 10: announced $200,000 to Michael Aram, Inc.

- Dec. 17: announced $12.1 million to Microsoft Corp.

- Dec. 18: announced $1 million to Cataler North America

- Dec. 19: announced $4.8 million to Aircraft Solutions USA

That’s over $35 million to corporations after vetoing a standalone teacher pay bill.

For background reading

See this discussion of the four policy combinations on corporate taxation and welfare. It explains that different combinations, and it discusses which combo Cooper chooses and why.