Zachary Halaschak of the Washington Examiner documents more bad news for the Golden State’s economy.

A new health care proposal that would nearly double California’s tax revenue has the potential to push more people out of the state.

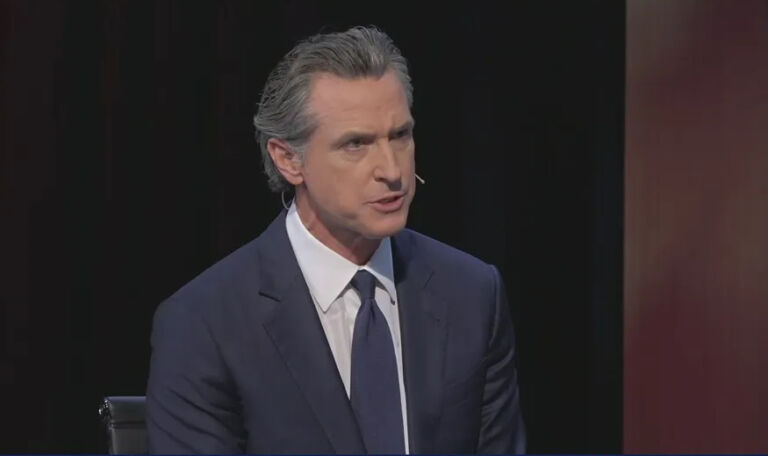

The ambitious legislative proposal would create a single-payer healthcare system and use the increased taxes to fund it. While the legislation faces an uphill battle, Gov. Gavin Newsom has publicly voiced support for single-payer systems in the past. He has yet to weigh in on the new legislation.

Jared Walczak, vice president of state projects at the Tax Foundation, told the Washington Examiner that if passed, the legislation would amount to a $163 billion per year tax increase that would effectively double state collections. That increased revenue comes with a cost, though, one borne by taxpayers that could push residents to lower-tax states.

“You would expect to see a substantial exodus of businesses and middle- and high-income earners,” Walczak said of California if the tax-and-spend proposal were to become law.

Kyle Pomerleau, a senior fellow at the conservative American Enterprise Institute, explained that the proposal includes three main revenue raisers: an increase to income taxes for high-income individuals, a payroll tax on workers’ wages for companies of a certain size, and a gross receipts tax.

Under the new proposal, the top marginal income tax rate would sit at a whopping 18.05%, a number that is much more than the 12.3% rate that those at the top of the bracket are paying now to live and work in the Golden State.

The payroll tax plan applies to employees with more than $49,990 in annual income and could be seen as creating a tax cliff because it only applies to companies with more than 50 workers. Companies might try to avoid hiring more employees to avoid having the tax imposed, which could disincentivize businesses from expanding.