Today is the final reading of the tax reform plan. This bill has the likelihood of making it into a conference committee and being hashed out between both Senate and House members before being sent to the Governor for final approval. In lieu of that vote today in the Senate chamber, one of the left’s organizations have published an opinion piece stating why the use of specific tax ranking data is incorrect when comparing NC’s tax business climate to other states.

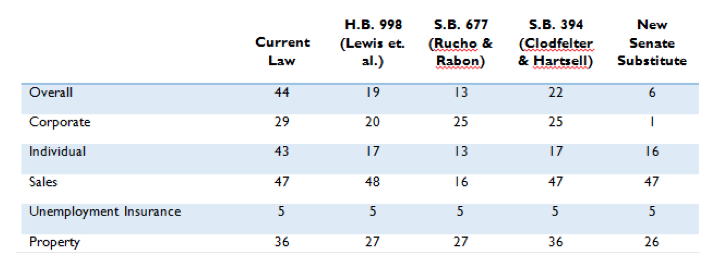

The data they refer to is the Tax Foundation’s business rankings moving from 44th to 6th best in the US. See the chart below:

Why does the Left say these rankings are not accurate? Well, here are their reasons (beware, they don’t sound very good to me either):

-

They focus exclusively on cherry-picked tax policies the Tax Foundation just doesn’t like, rather than on the whole range of factors that genuinely drive business investment decisions.

-

These business climate rankings bear no relationship to actual economic performance or conditions for business success.

-

The business climate rankings are glaringly different than other business climate rankings, even those produced similarly conservative organizations.

To start, one must fully understand the organization making these rankings before one can question their accuracy or validity. The Tax Foundation’s mission includes, “providing sound research and analysis on federal and state tax policy.” So, when the argument arises that these rankings do not take into consideration other variables that affect business climate, they are correct. The Tax Foundation’s rankings do not try to argue education, climate, housing, etc. They analyze tax policy – that is it. Everyone knows that CEOs of fortune 500 companies do not want to move their corporate headquarters to Wyoming, mostly due to the bad winter weather and the lack of metropolitan amenities. That doesn’t mean their tax environment is bad for business. Business climate variables and favorable business taxes are two separate arguments.

The Tax Foundation explains criticisms of their State Business Tax Climate Index in more depth here.