A privilege license tax is essentially a tax imposed for the privilege of conducting business in the state.

Building on North Carolina’s tax reform leadership, in 2014, the state’s General Assembly passed legislation to simplify this tax.

Before the reform, North Carolina cities or towns had the authority to levy a privilege license tax for doing business there, in addition to the state privilege license tax. This resulted in a hodgepodge of differing rates for different localities, leading to confusion and administrative costs on both businesses and the revenue department. Some cities chose to levy a flat rate, while others levied costs based on the company size, gross revenue, etc.

The Tax Foundation wrote that a hypothetical business would owe $30 in privilege license taxes in the city of Dunn, but would owe more than $25,000 if it were located in Durham. These costs would be passed down in part to consumers, and largely at the expense of worker wages. Thankfully, the legislature abolished the municipal authority to levy a privilege license tax in 2014.

North Carolina still levies a privilege license tax at the state level, however, and there is more that can be done to remove this perplexing and unnecessary tax.

Currently, the state imposes the tax on persons in a random patchwork of occupations.

Persons in these occupations must pay a privilege license tax:

- Photographers

- Architects

- Land surveyors

- Embalmers

- Home inspectors

- Physicians

- Veterinarians

- Funeral directors

- Accountants

- Bookkeepers

- A person who practices a professional art of healing

And more.

The rates levied are nonneutral. Varying occupations have their own unique tax. A pawnbroker must pay $250 each year, for example, while a land surveyor must pay $50 each year.

Persons in these occupations are exempt from paying a privilege license tax:

- Live entertainment

- Motion picture shows

- Amusements

- A person employed by an architect “as a draftsman only”

- A person selling grave plots

- Anyone over the age of 75

- “A person practicing the professional art of healing for a fee or reward, if the person is an adherent of an established church or religious organization and confines the healing practice to prayer or spiritual means”

And more.

Recall that the privilege license tax is not a license to practice – that is a separate issue. This is an additional tax to do business in the state. According to the North Carolina Department of Revenue’s recent publication: “Obtaining a license does not of itself authorize the practice of a profession, business, or trade for which a State qualification license is required.”

A privilege license tax is a government barrier to work. And we don’t need it.

The privilege license tax is nonneutral. A sound tax code would tax similar activities at the same rate. Moreover, the tax lacks transparency – it is hidden from consumers who are faced with higher prices as a result. The tax is also complex: the varying rates and list of exempt occupations are a real headache for those trying to comply.

Finally, it doesn’t generate significant revenue.

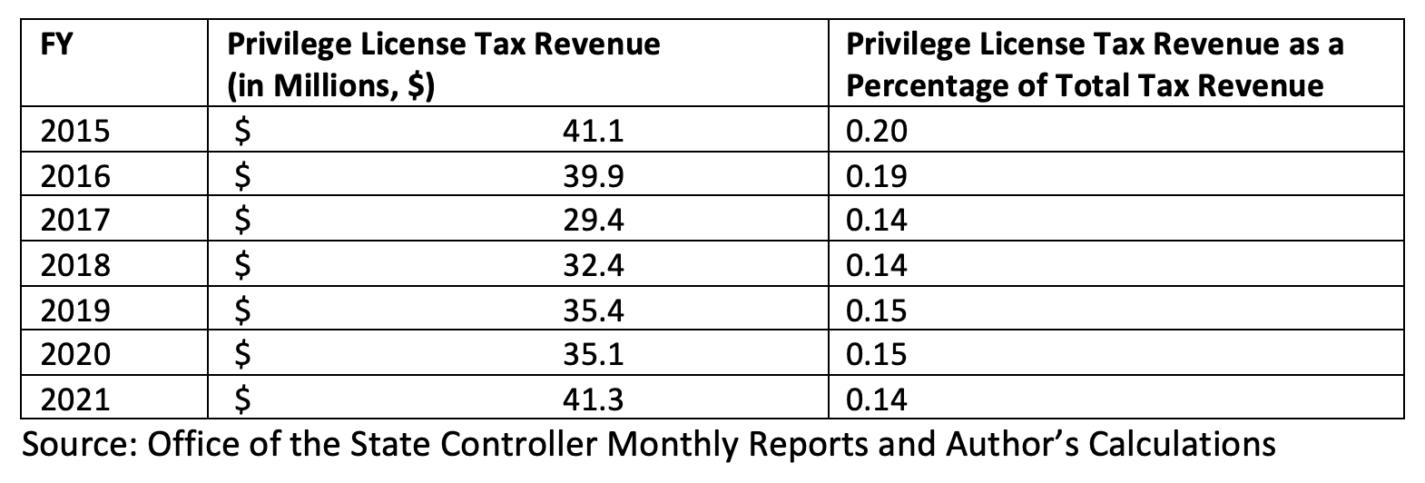

Privilege license taxes bring in very low relative revenue. Revenue over the last few years ranged between 29 million and 41 million for the whole state. This is generally less than 0.2% of total tax revenue.

Other states are making progress to pare back their privilege license taxes. Tennessee’s governor introduced a plan to cut the state’s professional privilege tax in half, after removing more than a dozen occupations from the state’s privilege license tax entirely. South Carolina simplified their privilege license tax, making similar progress to North Carolina’s recent reforms.

North Carolina lawmakers should consider simplifying our privilege license tax further, by eliminating it.