A recent article in The Business Journals highlights North Carolina’s tax reform as a “game changer” for bringing businesses and growth to the state.

Beginning in 2013, North Carolina transformed its tax code, dismantling barriers to growth. The article states: “Since implementing a series of reforms in 2013, North Carolina went from the highest corporate tax rate in the Southeast to the lowest in the entire country at just 2.5%.”

And with the latest state budget phasing out the corporate income tax, North Carolina will become one of just three states with no corporate income tax or statewide gross receipts tax.

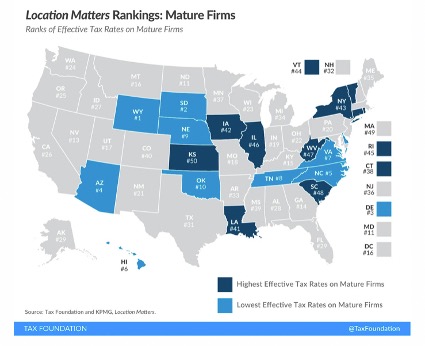

The article references the landmark “Location Matters” study from the Tax Foundation and KPMG LLP that compared the corporate tax cost in all 50 states. The study is comprehensive, accounting for all business taxes, including corporate income taxes, property taxes, sales taxes, unemployment insurance taxes, capital stock taxes, inventory taxes, and gross receipts taxes. It ranks North Carolina 3rd overall for new firms and 5th for mature firms.

A competitive business climate from low taxes benefits more than just business owners. It translates to an overall better place to live: better jobs and more job creation for working families.

Why? The tax burden from business taxes that stifle such growth is borne by workers, often in the form of lower wages or less employment. Indeed, North Carolina had the fourth-highest unemployment rate in the nation in 2012. In 2021, North Carolina had the 26th highest rate of unemployment. Consumers also bear business tax burdens in the form of higher prices.

Keeping our tax code competitive allows businesses and workers to flourish, with more Americans calling North Carolina home.