Alexander Bolton reports for The Hill that a prominent Democratic senator has decided to reject President Biden’s latest tax proposal.

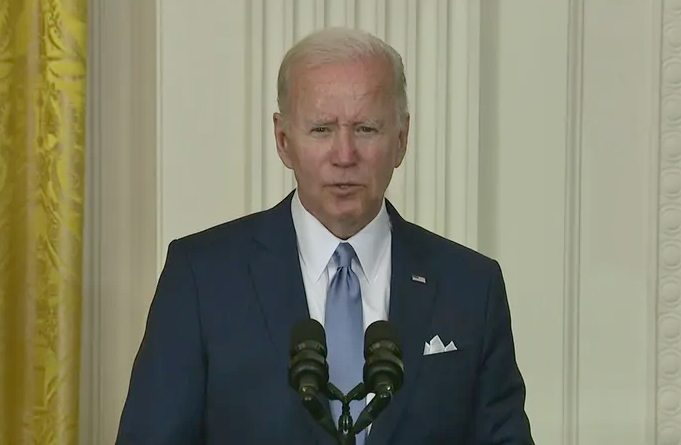

Centrist Sen. Joe Manchin (D-W.Va.) on Tuesday shot down President Biden’s new plan to raise $360 billion in revenue by imposing a 20 percent minimum tax on billionaires, a proposal the president formally unveiled Monday in his budget request to Congress.

Manchin says he doesn’t support the president’s plan to tax the unrealized gains of billionaires, which would set a new precedent by taxing the value an asset accrues in theory before it is actually sold and converted into cash.

“You can’t tax something that’s not earned. Earned income is what we’re based on,” he told The Hill. “There’s other ways to do it. Everybody has to pay their fair share.”

“Everybody has to pay their fair share, that’s for sure. But unrealized gains is not the way to do it, as far as I’m concerned,” he added.

Manchin’s opposition means Biden’s proposal is likely dead only a day after the White House unveiled it.

It could be significantly restructured to avoid taxing unrealized gains, which would pose the big challenge of trying to make up the lost revenues.

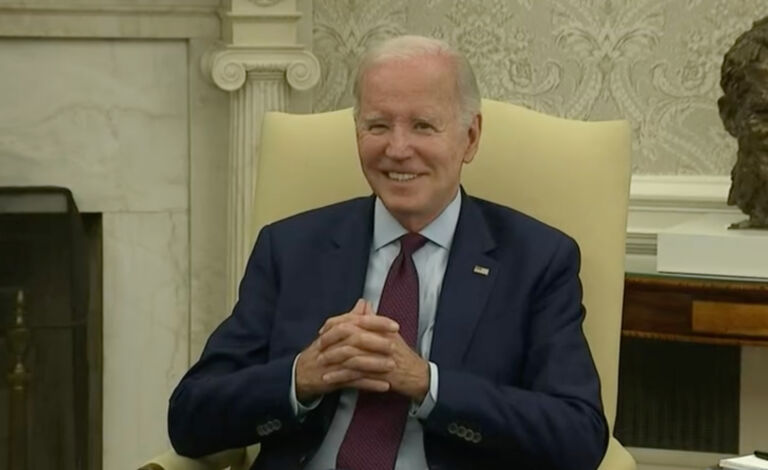

The problem with taxing just the regular income of billionaires is that many of the nation’s richest individuals, such as Jeff Bezos and Elon Musk, have been able to pay little or nothing in income tax by not declaring income.

Instead, the ultra-rich often can take out loans secured by the value of their assets to finance their lavish lifestyles.

“Here’s what they do. They go to their accountant. They tell their accountant, ‘Make sure I don’t make any income, any salary.’ And then they say, ‘Make sure I can buy, borrow and die.’ And nobody knew anything about that years ago, and now people are pretty up on it,” said Senate Finance Committee Chairman Ron Wyden (D-Ore.), who has announced his own proposal to tax the unrealized gains of billionaires.