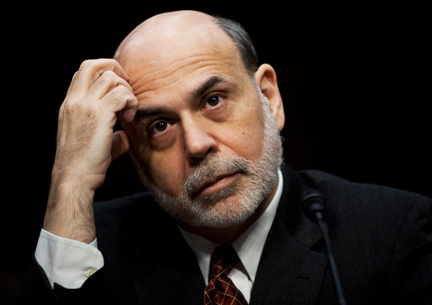

If you believe the Federal Reserve deserves much of the blame for the nation’s current economic woes, you’ll likely cringe when you read the following excerpt from the latest Bloomberg Businesweek:

If you believe the Federal Reserve deserves much of the blame for the nation’s current economic woes, you’ll likely cringe when you read the following excerpt from the latest Bloomberg Businesweek:

Under [Ben] Bernanke’s chairmanship, the Federal Reserve has resorted to measures that are unprecedented in the bank’s 99-year history. It lowered its target interest rate as much as it could, from more than 5 percent in 2007 to between zero and 0.25 percent since 2008. It bought almost $2 trillion in long-term bonds. And it kept stretching out how long it intended to keep rates superlow. The latest target date, announced on Sept. 13, is at least through mid-2015, nearly eight years after the economy first tipped into recession. In a speech in Jackson Hole, Wyo., on Aug. 31, Bernanke conceded that the Fed is making it up as it goes along. He called this “the process of learning by doing.”