In 1992, Louisiana became the first state in the nation to offer incentives for film productions. At first, few states bothered to adopt similar giveaways. The 2000s saw a flurry of state film incentives, as each state tried to outbid the others for productions, thinking economic growth would surely follow. By 2009, all but six states had them.

Then the trend reversed sharply. As of this writing, 19 states are choosing to avoid state incentives programs for film productions. Several others are considering repeal by cutting back their programs.

North Carolina isn’t among them. North Carolina currently holds a dubious distinction in the National Conference of State Legislatures’ page on state film production incentives programs. “Since 2009, 13 states have ended their film incentive programs,” NCSL noted. But North Carolina is deliberately running in the opposite direction:

While most states maintained the status quo or reduced film incentives, a few states made slight augmentations to their programs. North Carolina, which switched from a tax credit to a grant program in 2015, increased its annual program cap to $34 million for FY 2018 and eliminated the program’s July 1, 2020 sunset date. Additionally, Utah and Virginia made small increases to the annual funds available for film incentives.

After reviewing the NCSL page, we know the following:

- Over one-third of U.S. states aren’t providing film production incentives

- Five more states have cut back or capped their programs

- All but three of the remaining incentives states have made no changes

- Utah and Virginia made small increases to their programs

- North Carolina tripled its grant program and then effectively eliminated the program’s accountability by getting rid of its sunset date

What happened? Didn’t North Carolina get the memo? While North Carolina is taking the deep dive, why are the other states getting out, pulling back, or at least not deciding not to sink any deeper?

Investing dollars to capture pennies

Third-party studies of state film incentives programs consistently found that they don’t help the state’s economy or other industries. For example, a 2016 study in the academic journal The American Review of Public Administration, Prof. Michael Thom of the University of Southern California found that state film incentive programs have no impact on their states’ economies or industries. Thom’s research detailed why film incentives programs don’t work, basically benefiting just outside film production companies and current workers.

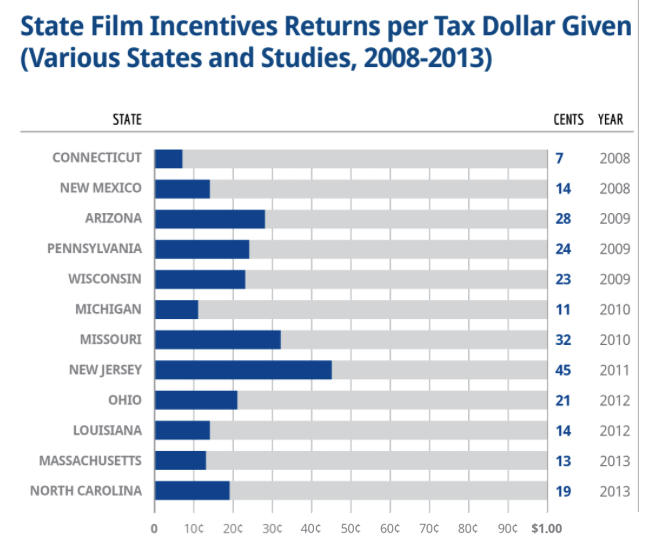

State reviews of their own film incentive programs found them to be net money losers (see the chart below). While some states such as Louisiana retained their programs regardless, others decided to pull the plugs on theirs.

That chart is a few years old now. In the course of checking the current disposition of state film incentives programs, I have encountered a few new ones.

Virginia

A November 2017 evaluation by the state Joint Legislative Audit and Review Commission found that Virginia’s Motion Picture Production Tax Credit generated a return in revenue of only 20 cents per dollar. The evaluation found that the Governor’s Motion Picture Opportunity Fund (grant program) generated a return in revenue of only 30 cents per dollar.

West Virginia

A January 2018 agency review of the state Film Tax Credit Program from the West Virginia Legislative Auditor, Performance Evaluation & Research Division, found that the $15.11 million in tax credits issued had generated $6.15 million (only 41 cents per dollar) in economic impact, to which was applied a multiplier of 1.411 to estimate an economic impact of $8.68 million (only 57 cents per dollar). In February, Gov. Jim Justice signed a law ending West Virginia’s film tax credit program.

Florida

A January 2018 report from the state Office of Economic and Demographic Research found that the Florida Entertainment Industry Financial Incentive Program (tax credits to offset sales and use tax or corporate income tax) generated a return on investment of only 18 cents per dollar. That program was ended in 2016. The report found that the Florida Entertainment Industry Sales Tax Exemption Program generated a slightly higher return on investment that was still only 58 cents per dollar.

Opening the doors to all rather than playing favorites

Rather than have the state play favorites with special deals for one industry but not others, I have argued for an “All-Comers Economic Incentive“:

Is there a way to make it even more affordable for film companies to do business in North Carolina without being unfair to other taxpayers? Especially businesses who are already here and already creating jobs and economic benefits for North Carolinians? Yes, there is, and in fact, state leaders are already doing it.

By giving tax cuts to all industries rather than just this one or that one, North Carolina has had brisk economic growth, outpacing national and regional averages. It’s created an environment where people can produce economic development, and they’ve responded.

We’ve also had four consecutive years of budget surpluses [note: it’s now five]. We’re considered a national model for tax reform.

In the NCSL list, some of the states without film production incentives let it be known they already offer tax breaks without favoritism. They include:

- Delaware “does not levy a sales tax.”

- Florida “does not levy a state income tax.”

- New Hampshire “has no sales and use, or broad base personal income taxes.”

- South Dakota has “no corporate or personal income tax.”

North Carolina has become a national outlier by significantly increasing a government grant program to incentivize film production. North Carolinians should ask policymakers why they’ve tripled down on the choice to play favorites.