North Carolinians have been reeling from pandemic job losses and the related shutdowns. While many folks have had access to unemployment benefits and federal relief checks, it’s important to focus on the long-term outlook for financial stability and self-reliance. That’s exactly what a plan from state senators would do with a proposal to provide tax relief.

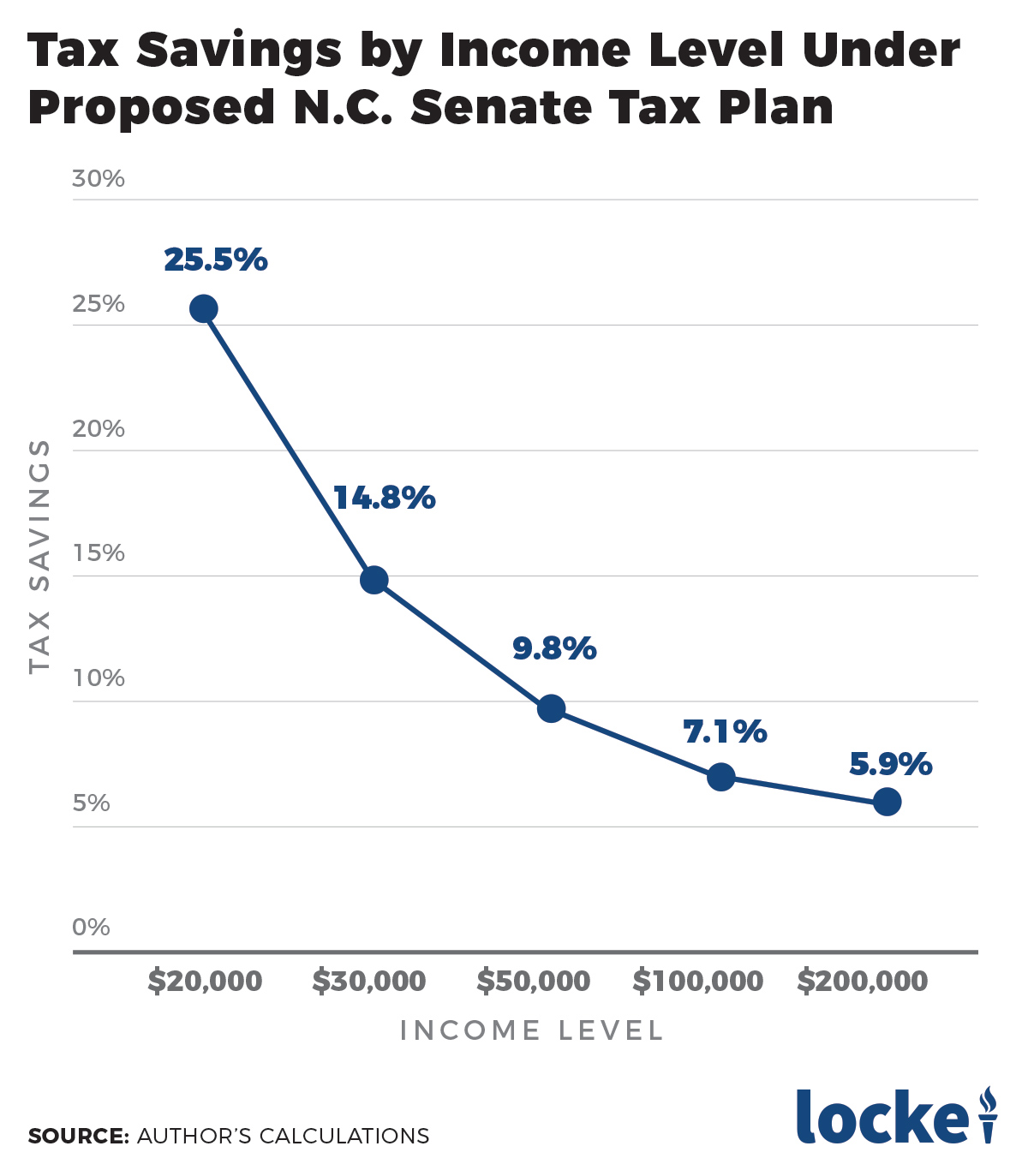

As Mitch Kokai details for Carolina Journal, everyone who pays state income tax would benefit. But it’s those with lower incomes who would benefit the most. Check out the chart with Mitch’s description of how the tax relief would work. As you can see, the range of relief runs from 25% for those with the most modest income, to 5% for the highest earners.

Let’s look at prospective changes in income tax bills for single earners with no children making $20,000, $30,000, $50,000, $80,000, $100,000, $200,000, and $1 million.

The $20,000 earner would see his income tax bill drop from $485 to $361.

That’s a cut of more than 25%.At $30,000, the bill drops from $1,010

to $860 (15% cut).At $50,000, the bill drops from $2,060 to $1,858 (almost 10% cut).

At $80,000, the bill drops from $3,635 to $3,355 (8% cut).

At $100,000, the bill drops from $4,685 to $4,353 (7% cut).

At $200,000, the bill drops from $9,935 to $9,343 (6% cut).

At $1 million, the bill drops from $51,935 to $49,263 (5% cut).

As you can see, the tax cut proposal wouldn’t be a giveaway to ‘the rich.’ It would help the poor much more than the wealthy.

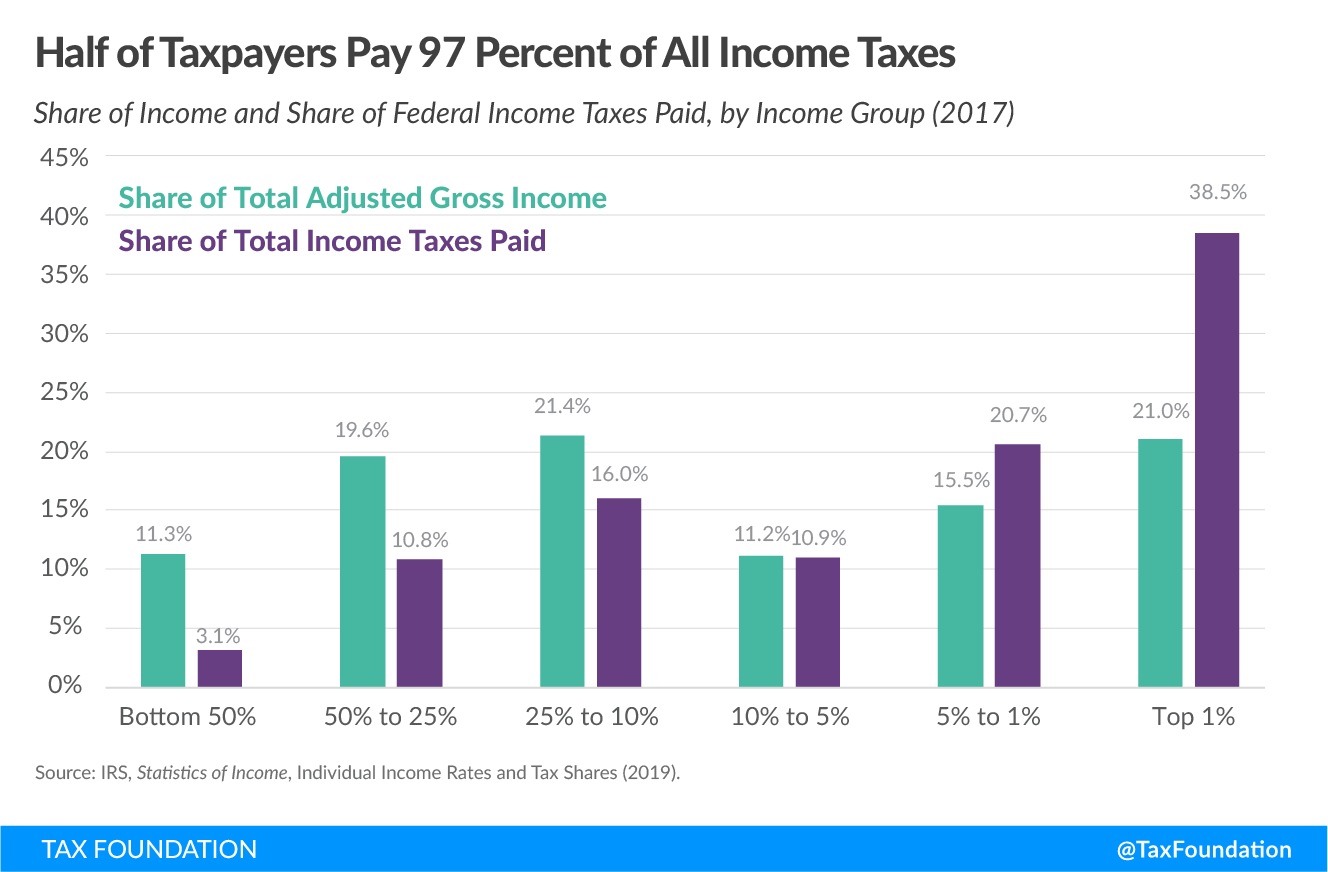

Speaking of the wealthy, at the federal level, President Biden and his progressive allies want to adopt a $2 trillion “infrastructure” plan and pay for it by raising taxes on high earners and corporations. The Democrats like to say that the rich don’t ‘pay their fair share.’ When it comes to federal income taxes, the wealthy actually pay MORE than their fair share, as this data from the Tax Foundation clearly illustrates.