The Tax Foundation published another one of their nationwide comparisons maps, and this time it highlighted a lower corporate income tax rate for North Carolina. This is the first time in fourteen years North Carolina has seen their rate drop. Last year the legislature enacted a tax reform package which dropped the corporate income tax from 6.9 percent to 6 percent. The tax had been 6.9 percent since 2000 and was 7 percent before that, making it the highest corporate income tax in the Southeast.

Here is the analysis of the map from the Tax Foundation:

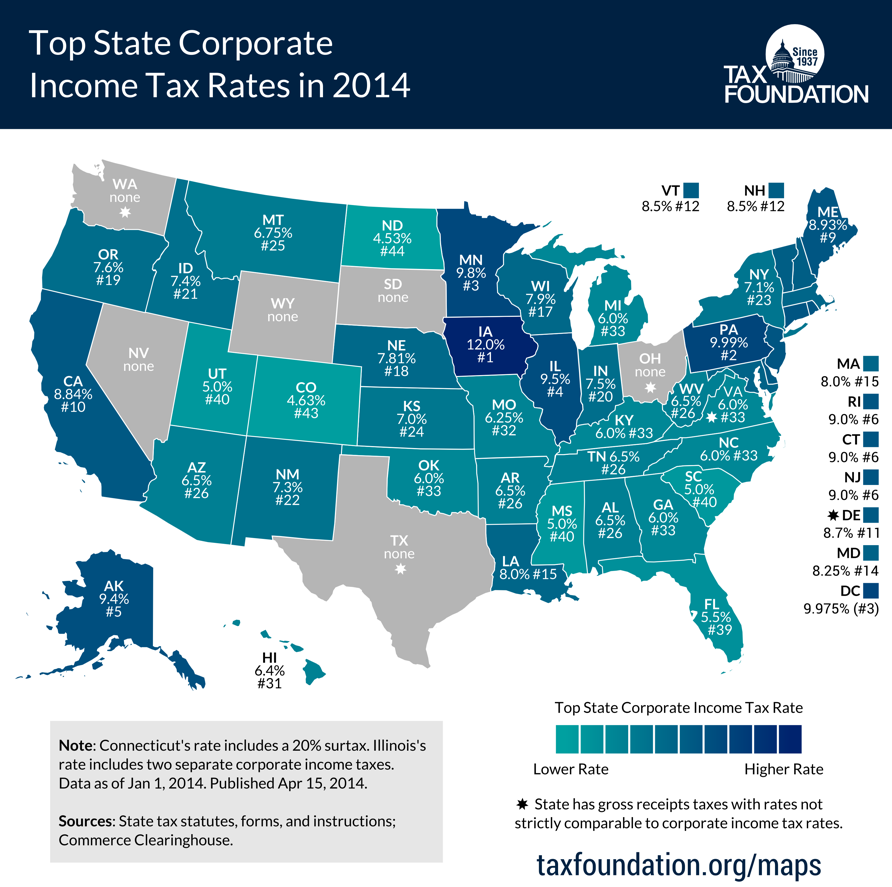

This week’s map shows top corporate marginal tax rates in each state. Corporate income taxes vary widely, with Iowa taxing corporate income at a top rate of 12 percent (though the state allows deductibility of federal taxes paid), followed by Pennsylvania (9.99 percent), Minnesota (9.8 percent), Illinois (9.5 percent), and Alaska (9.4 percent). On the other end of the spectrum, North Dakota taxes corporate income at a top rate of 4.53 percent, followed by Colorado (4.63 percent), Georgia, Mississippi, and Utah (5 percent).Some states do not levy a corporate income tax at all, and instead levy gross receipts taxes, which are more harmful. Ohio levies the Commercial Activities Tax (CAT), Texas levies the Margin Tax, and Washington levies the Business and Occupation (B&O) tax. Virginia and Delaware levy both gross receipts taxes and corporate income taxes. Nevada, South Dakota, and Wyoming do not levy a corporate income tax or a gross receipts tax.Economic studies find that corporate income taxes are among the most harmful to economic growth, while sales and property taxes are found to be less damaging to growth.