The NC Senate signaled their intentions Wednesday to aggressively lower the state’s personal income tax rate.

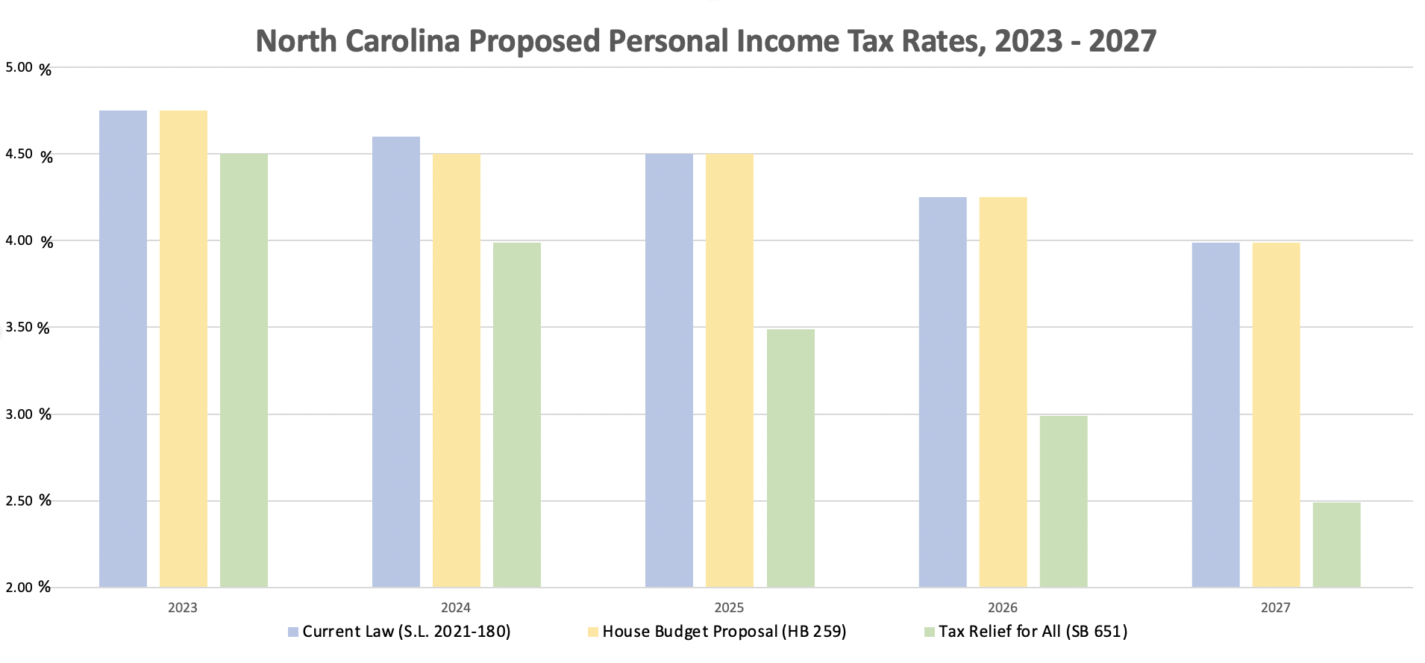

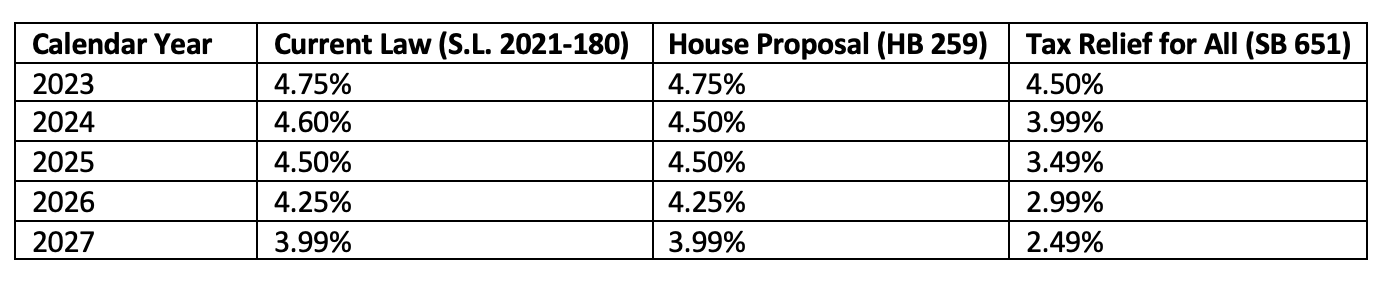

The current year’s tax rate is 4.75% with decreases scheduled that would bring it to 3.99% after 2026. SB 651, titled “Tax Relief for All” would lower the tax rate to 2.49% after 2026. The first decrease would apply retroactively to the current year, bringing our present rate down to 4.5%. In 2024 the rate would drop to 3.99%.

This is more aggressive than the personal income tax cuts unveiled in the NC House budget proposal last week. Under that proposal, the rate would decrease to 4.5% one year earlier than scheduled.

See the below graph for a comparison of the current schedule, the House proposal, and the new Senate bill. A table representation is below as well, providing the exact rates proposed.

Bill sponsor Senator Paul Newton (R-Cabarrus) said, “Our tax policy has proven successful … We believe this tax package will return a significant amount of money to taxpayers while still maintaining the needed revenue to run the state smoothly.”