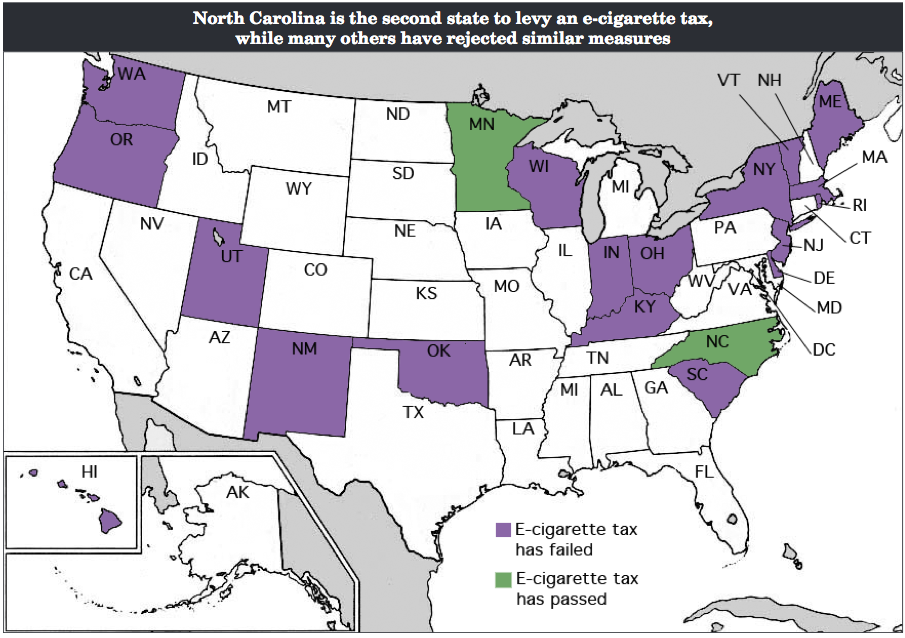

Over the last decade, there has been increased use of electronic cigarettes or vapor products. Not surprisingly, this has caught the eye of legislators who are often on the look out for new and creative ways to extract revenues from the citizenry. In May, state legislators decided to change the existing tax code by placing a new excise tax on e-cigarettes. Defying sound principles of taxation, beginning on June 1 of 2015, the liquid in e-cigarettes will be taxed at an additional 5 cents per milliliter. Add-on e-cigarette tax bills have been introduced in 20 states, but only two have enacted them — Minnesota in 2012 and North Carolina in 2014. Eighteen states have said no. E-cigarettes are already subject to state sales taxes in all states.

To learn more about this new tax, check out my new spotlight on Electronic Cigarettes.