As health care costs continue to rise, patients continue to struggle to navigate the healthcare system, and Congress cannot agree on the direction of health care reform, many are calling for lawmakers to scrap the whole system and transition to a single-payer system.

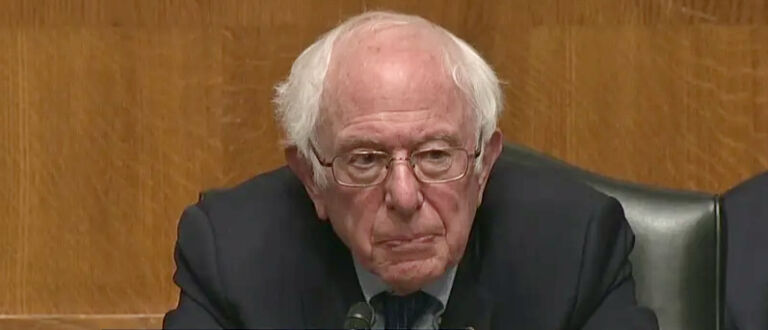

Commonly referred to as Medicare-for-All and championed by the likes of Bernie Sanders, a single-payer system would transition all Americans into a government-sponsored and administered health care plan. We live in a country with the highest healthcare costs per capita, which are still rising. For this reason, many believe the transition to single-payer is the only way to combat America’s healthcare costs problems.

Charles Blahous of the Mercatus Center conducted a study last summer which has been used heavily in the Medicare-for-All debate. However, the findings from this study have been wildly misconstrued. Dr. Blahous’s study concluded that the price tag of Medicare-for-All as envisioned by Bernie Sanders would total $32 Trillion in additional costs in the federal budget. Single-payer advocates have latched on to the talking point that Dr. Blahous’s analysis would actually save $2 trillion dollars in healthcare spending by comparing the studies lower bound estimates to current projected national healthcare expenditures. Here is Dr. Blahous on how people have misunderstood the conclusions in the paper:

However, a critical additional reason why the attribution of $2 trillion in savings is wrong is that it is inconsistent with the study’s conclusions. Some have attempted to convert the study’s lower-bound federal cost estimate of $32.6 trillion into an estimate of savings in national health spending, arriving at the $2 trillion number.

The key is the difference is that people have conflated Dr. Blahous’s estimates of additional federal spending with overall national health expenditures. Dr. Blahous has publicly refuted the misuse of this claim and offers a new example of how the people came to misunderstand the numbers:

Imagine that members of a family have separate cell-phone data plans that add up to $57 a month. Now imagine the following conversation:

Q: How much would it cost my mother to buy my cell-phone data for me instead of continuing to pay it for myself? I think she’s better than I am at negotiating a good deal.

A: Well, if she buys it and allows you to use it for free, your usage will typically go up. Even if she’s the brilliant negotiator that you say, it’s going to cost her at least another $33 a month on top of her current expenses. Most likely her extra costs would be between $33-$39, possibly more.

Q: But then it wouldn’t cost me anything, right? Don’t you have to think of it in terms of how much money everyone in the family, together, would pay? If she bought it, how much would my family as a whole be paying?

A: Well, she was already paying $22 each month, so altogether the family would pay at least $55, probably between $55-$61, again possibly more

Q: But otherwise we’d pay $57. So, you’re saying we’ll save $2 a month because of her superior negotiating skills?

A: No, I didn’t say anything about her negotiating skills; you did. Her actual history shows a tendency to overspend. I’m just saying that even under your assumption, it’s going to cost the family at least $55, probably somewhere between $55-$61. It’s actually highly unlikely it would be as low as $55.

Q: Great, so you’re saying we’ll save $2!