Though the national media often fails to give them attention, state tax reforms are underway across the country.

Over the past decade, North Carolina has led the way in state tax reform. In 2013, North Carolina levied the highest personal income tax in the southeast, with a top rate of 7.75%. Our standard deduction was low, and the corporate income tax was high at 6.9%. Thanks to conservative reforms in the legislature, namely restrained spending, North Carolina is expected to phase out its corporate income tax entirely, and our flat personal income tax will drop to 3.99% by 2027.

When North Carolina switched from a progressive rate to a flat rate, it was only the third state to do so. Now nine states have flat income rates. Another nine levy no personal income tax at all. And in 2023, 11 states (including North Carolina) are reducing rates.

In the most recent news, West Virginia has proposed tax cuts that could eliminate their personal income tax entirely.

North Carolina remains competitive, but the tax environment is heating up resulting in new state tax leaders.

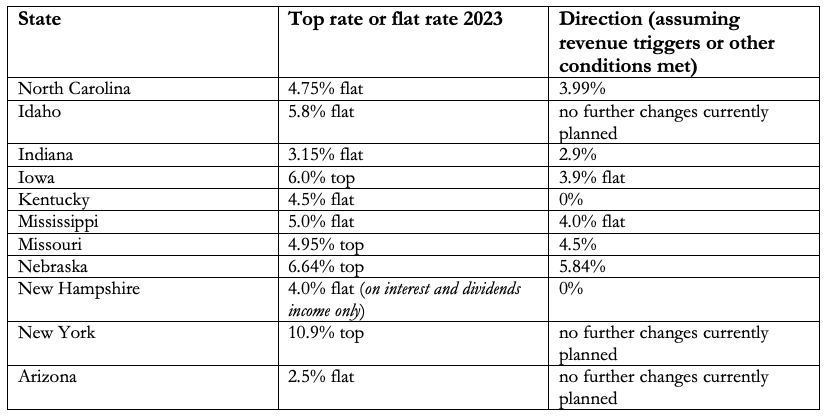

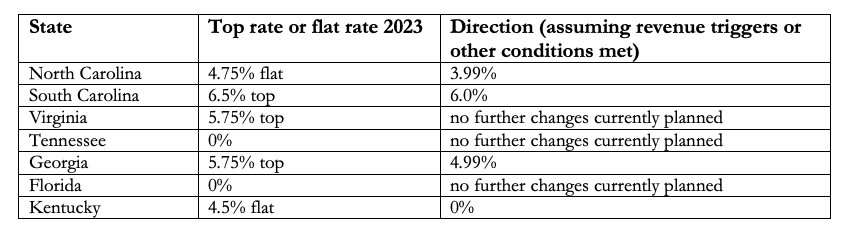

See the charts below to see where we stand compared to our neighbors, and to those reducing their personal income rates this year:

NC compared to other states reducing personal income tax rates this year

Of the 11 states reducing income taxes in the new year, five will or could be below North Carolina’s goal rate of 3.99%.

NC compared to neighboring states

Regionally, North Carolina is still competitive with the states that levy a personal income tax.

Not all states aimed to allow workers to keep more of their earnings, however.

Massachusetts went against the trend, raising taxes by adding an additional 4% tax on taxable income over $1 million.

Moreover, according to the Tax Foundation, legislators in seven states introduced bills to tax the wealth and capital gains of those they classify as “rich.” These proposals are economically destructive and would discourage the very kind of investments that will be sorely needed as the nation heads into recession. They would also likely encourage folks to move to lower-tax states like North Carolina, leaving middle- and lower-class workers to shoulder more of their states’ tax burden.

Even so, the majority of state-level tax changes are trending in the right direction: allowing workers to keep more of their earnings. These will be politically difficult to reverse.

Lowering taxes is always a laudable goal, because it keeps more money in the pockets of those who earned it rather than with the government, which is incentivized to increase spending. North Carolina may have room to accelerate our income tax reductions. But in the end, so long as government spending is limited and efficient, workers’ tax burdens can be similarly limited.