Last week, Blue Cross and Blue Shield of North Carolina received final approval to increase the underlying cost of 2017 health insurance premiums by an average of 24 percent. The state’s largest insurer initially sought approval for an 18 percent increase, but needed to re-file its rate request to account for an additional 200,000 enrollees who once purchased health insurance through Aetna. Aetna, along with UnitedHealth Group, have departed from the state’s health Exchange earlier this year. Blue Cross and Cigna are the only two carriers offering federally qualified health plans to people who don’t have job-based insurance through the Affordable Care Act’s individual market Exchange platform.

PBS reports that the White House continues to stress that these underlying premium increases don’t include subsidies which help offset total out-of-pocket costs enrollees pay towards their monthly premiums and deductibles (these sliding scale subsidies are distributed based on one’s household income).

Even with subsidies, these plans aren’t affordable for all. Healthcare.gov, the platform where patients can shop for a 2017 health insurance plan starting November 1, now allows you to preview available plans and their associated costs:

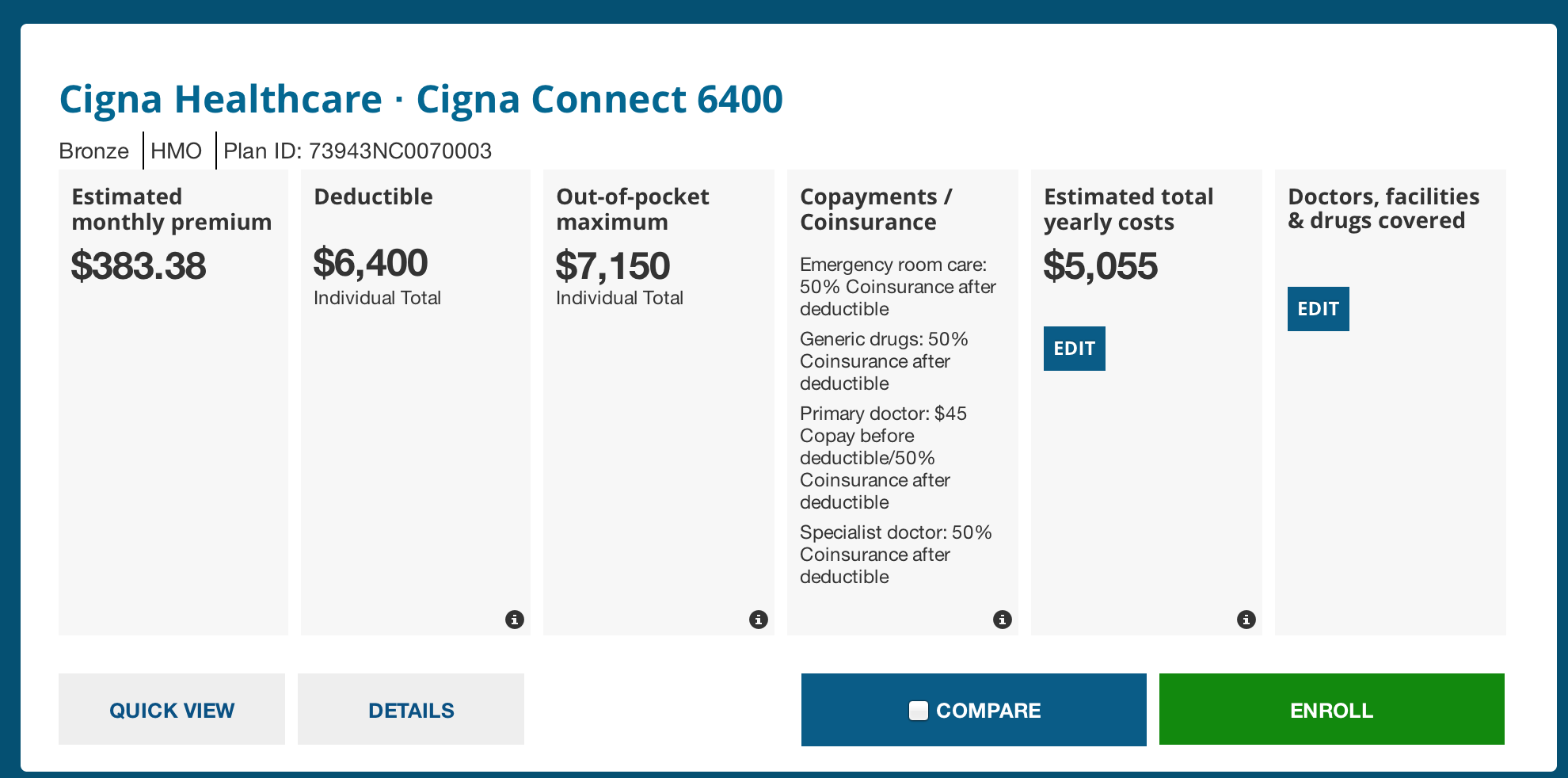

- A 40 year old female in Wake County earning $50,000 a year doesn’t qualify for a subsidy. The lowest cost HMO Bronze plan through Cigna is $383 a month in addition to a $6,400 deductible. A Blue Cross and Blue Shield bronze plan will cost her over $400 a month with a $7,150 deductible.

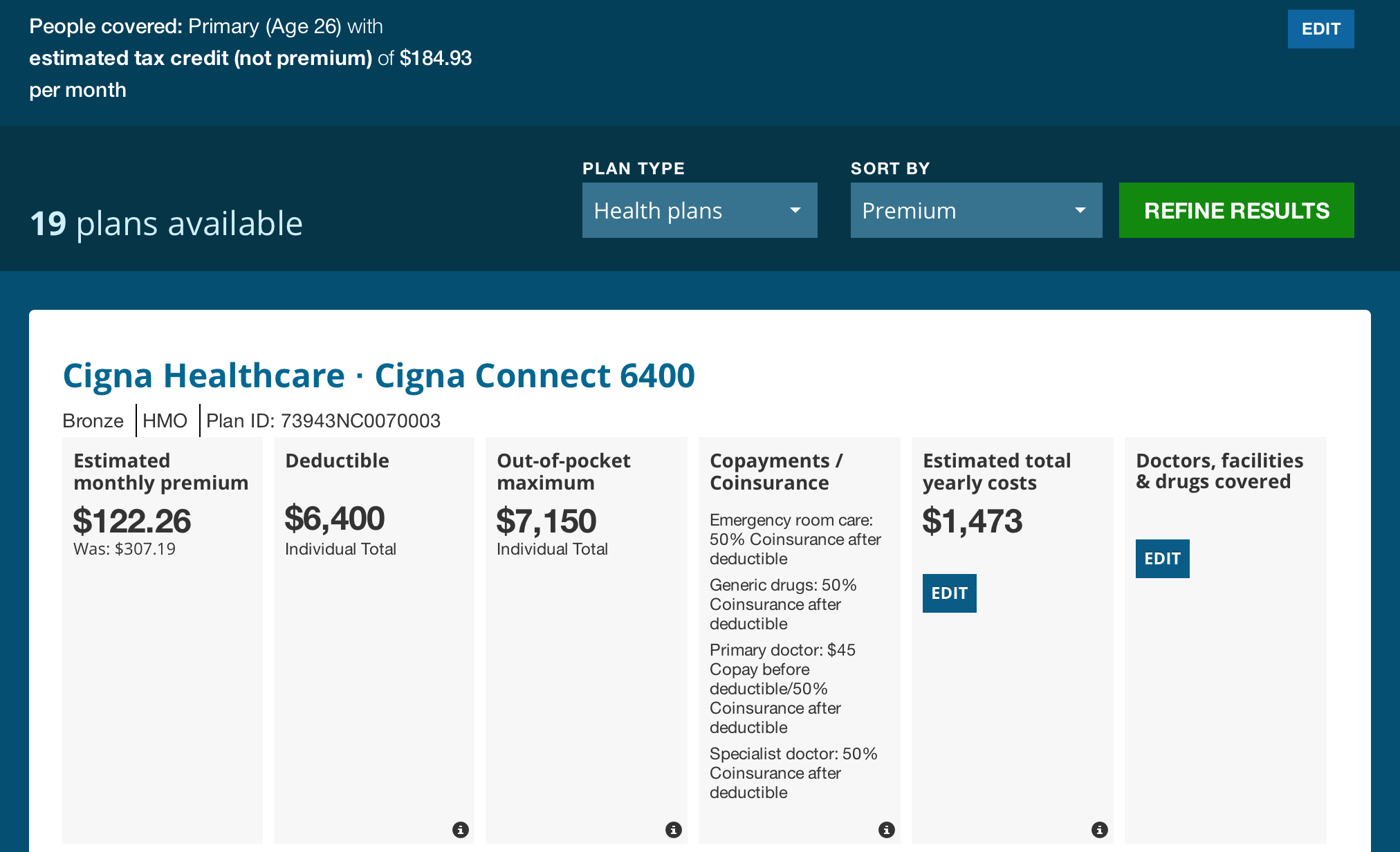

- Meanwhile, let’s say that a 26 year old male living in Wake County doesn’t have health insurance through his job. He’s pulling in $30,000 a year. Even with a $185/mo subsidy, his net premium payment amounts to $122 a month for the lowest cost Cigna plan. Add that to $6,400 in out-of-pocket expenses before the insurance company covers the bill.

Now, there is nothing wrong with high deductible health plans, however they would be way more appealing – especially for low users of the health care system, if premiums were lower. This doesn’t mean that there should be more subsidies. It means that the federal health law’s Exchange infrastructure needs to let insurance companies have more flexibility with their plan designs and risk- pricing. Of course, there’s a lot of other things that need to be reworked in order for health care to be more accessible and affordable for the masses.

What a mess.