North Carolina’s July unemployment rate remained unchanged at 3.4% for the fourth consecutive month according to the latest release from the North Carolina Department of Commerce. The national rate decreased by 0.1% to 3.5%.

North Carolina employers added 14,216 jobs over the month with Government and Professional and Business Services making the most gains. Government jobs alone grew by 12,900, or 1.8% over the month.

Since July 2021, total private sector jobs in the state have increased by 158,800 or 4.1%. Government jobs have decreased by 4,300 or 0.6% over the year.

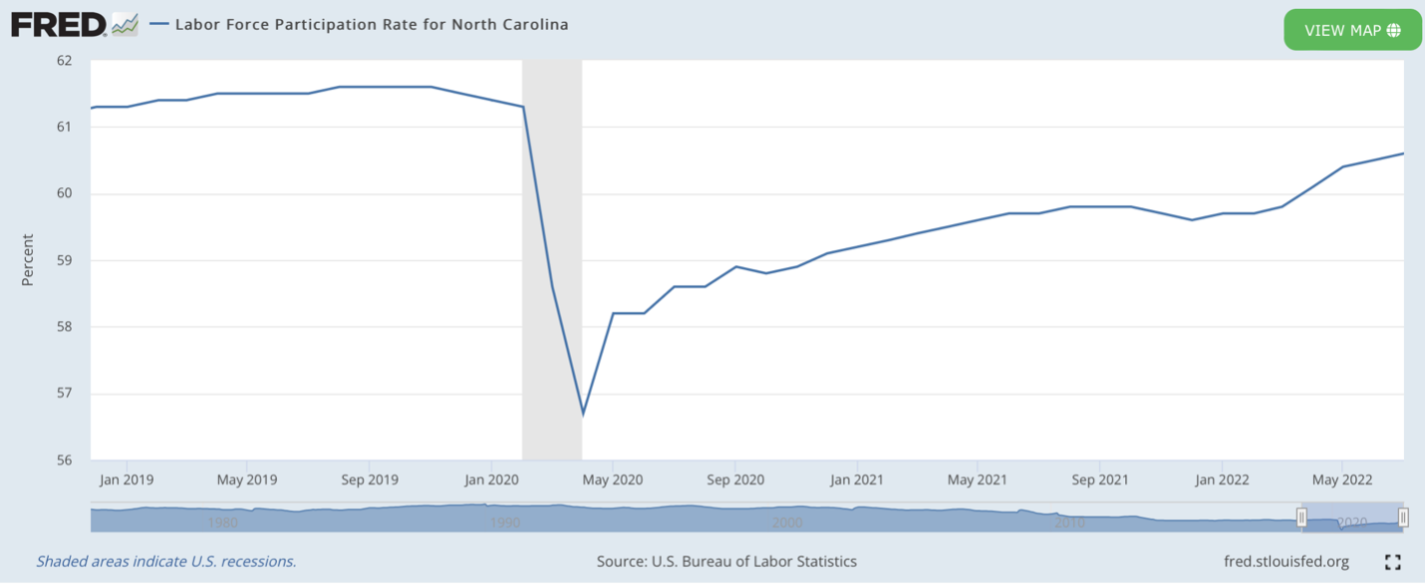

The state’s seasonally adjusted labor force participation rate (the number of employed and unemployed looking for work divided against the state’s civilian population) has increased steadily since December 2021. July’s rate increased again to 60.6%. Before the pandemic, however, the rate was 61.3% in February 2020.

North Carolina’s economic picture, then, is grimmer than the unemployment rate and jobs numbers show. The labor force is smaller. This is primarily driven by fewer unemployed people looking for work.

In February of 2020, there were nearly 11,000 more unemployed individuals searching for work than today. People have left the labor force for various reasons and North Carolina is consistent with the national trends of a smaller labor force.

If labor force participation were at pre-pandemic levels, North Carolina would have 59,084 more people in the labor force. Similarly, if North Carolina had the same number of people employed, but with the larger labor force, unemployment would be 4.5%.

Moreover, looking under the surface of the jobs numbers, we find diverging data. The difference in household and payroll surveys (with payroll surveys showing greater gains) implies that people are taking up second and third jobs to combat inflation.

Inflation continues to stretch families’ budgets as it surpasses any wage gains. In North Carolina, according to the most recent data, wages increased 1.79% over the month (not seasonally adjusted) from $1,007.23 to $1,025.23. Over the past year, average private wages are up 5.87% in the state. Though this is a solid increase, inflation overtakes these wage gains, causing real wages to fall over the past year. At an annualized rate of 8.5%, inflation is a tax on all Americans, but low- and middle-class households are most harmed. Savings, too, are devalued.

Look beyond the unemployment rate and we find signs of an economy running out of steam. Businesses are struggling to hire workers, wage growth is not keeping up with inflation, and some families are taking second jobs to stay afloat.