This week, JLF’s Joseph Coletti published a research brief on the possibility of a taxpayer refund in North Carolina. North Carolina has $2.7 billion in unappropriated cash balances and excess projected revenue, and some lawmakers in the state are considering what to do with that money. According to Coletti:

With Democrats all but officially closing the door on a budget deal (they still claim to want “everything on the table” in negotiations) Senate President Pro Tem Phil Berger has begun “thinking about how we can provide a refund to the taxpayers of the state of North Carolina.”

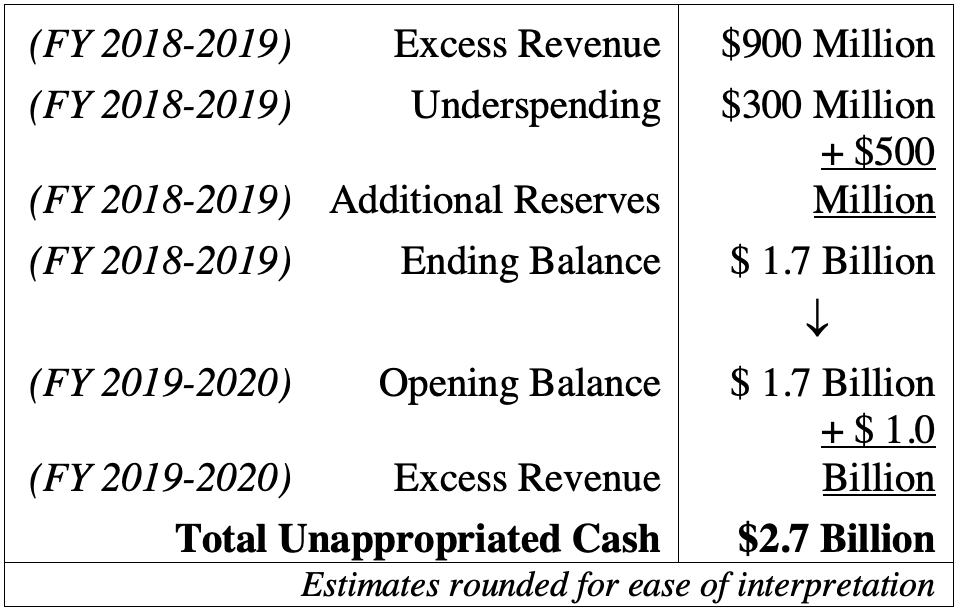

According to Coletti, state revenues came in almost $900 million ahead of budget, and state agencies spent about $300 million under budget. Those monies (plus additional reserves and minus additional commitments) bring North Carolina to a 2019-2020 opening fiscal year balance of $1.7 billion. On top of that, expected revenue is $1.0 billion more than the state needs for continuing appropriations and debt services. That leaves, without a new budget in place, $2.7 billion in unappropriated cash through June 2020.

According to Coletti, state revenues came in almost $900 million ahead of budget, and state agencies spent about $300 million under budget. Those monies (plus additional reserves and minus additional commitments) bring North Carolina to a 2019-2020 opening fiscal year balance of $1.7 billion. On top of that, expected revenue is $1.0 billion more than the state needs for continuing appropriations and debt services. That leaves, without a new budget in place, $2.7 billion in unappropriated cash through June 2020.

This amount could change drastically, however, if the state government comes to a consensus and imposes a budget which incorporates these extra funds. Most lawmakers do not propose refunding the full $2.7 billion. Coletti explains:

More often, casual conversation and meaningless speculation have considered refunding the $900 million revenue surplus. Another line of thought would consider refunding the $266 million in extra revenue and reversions since May’s estimates.

So how much could N.C. taxpayers receive? According to Coletti:

If the state returned a set amount for each of North Carolina’s 10.4 million residents, the refund would be between $25 (at $266 million) and $260 (at $2.7 billion) per person, but the amount would grow as the size of a household grew, so a family of four could receive between $100 and $920.

Read the full research brief here. Read more fiscal insights from the JLF team here.