Thanks to fiscally conservative policies of spending restraint and saving, state debt continues to trend downward as highlighted in the Debt Affordability Advisory Committee’s (the Committee) annual report submitted to the Governor and General Assembly last week. The report, spearheaded by North Carolina Treasurer Dale Folwell, advises on the state’s debt capacity and recommends budget management policies.

The Committee cautions that “debt capacity is a limited and scarce resource” but states that North Carolina’s debt is considered manageable at current levels and better than most other states. The state’s total outstanding tax-supported debt stands at $5.7 billion.

The state debt, though large, is generally under control, and falling. The Committee has determined that General Fund debt is safely under guidelines for debt capacity, while General Fund net tax-supported debt has fallen 16% in the last four years.

But the state’s fiscal future is greatly dependent on the less transparent and more complex issue of unfunded liabilities.

North Carolina has $35.6 billion in unfunded pension and promised health care obligations for state retirees. The Committee recommends continuing to add annually to the Unfunded Liability Solvency Reserve to combat this harmful growth.

Ballooning unfunded liabilities for government retirees are a risk to the taxpayers who fund them. The government should cease its political gambit of overpromising retiree benefits it cannot afford. Unfunded liabilities hamper government’s ability to provide future, essential services.

The report also warns that transportation debt has increased substantially and will have reached full debt capacity by FY2026. North Carolina’s Department of Transportation has historically exceeded its anticipated spending by significant amounts (12.5% in FY 2019).

While the Committee recommends General Fund debt service payments be limited to 4% of revenues, it allows transportation debt service payments to grow to 6%, giving the fund greater flexibility to support higher debt levels. In the report, the Committee alludes to revisiting this guideline to transportation debt in the near future.

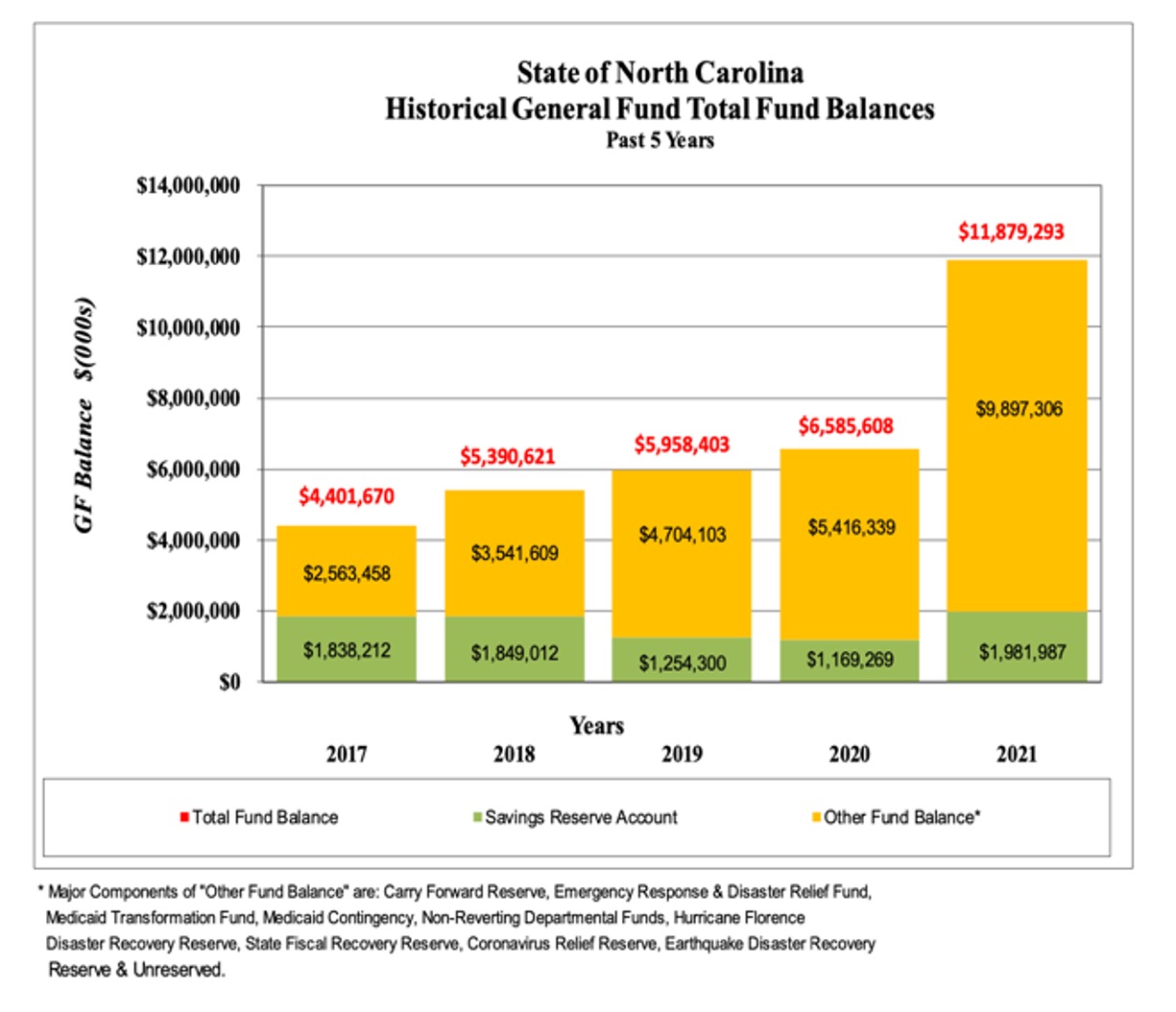

Concurrent with these concerns, the General Assembly has honorably emphasized maintaining a hearty reserve fund. With the most recent budget, they dedicated more than $3 billion to the Rainy Day fund, making the state well positioned to address a potential downturn. The chart below shows this dedication to savings and the growth in positive General Fund balance.

With ambitious increases to the Rainy Day fund and decreasing state debt, North Carolina continues to maintain its AAA credit rating. The biggest threat to North Carolina’s fiscal condition remains it sizeable and growing unfunded liabilities.