Short term “payday” lending is in the news again, it seems. The Obama administration’s Justice Department is beginning a new campaign against the lenders. Search engine giant Google has just announced it won’t sell ads to the lenders.

Paternalism is at the heart of this campaign. Reactive government paternalism is almost always accompanied by negative unintended consequences, and this is. I researched this issue in 2013 and found things weren’t quite what they appeared.

I wrote about it in my newsletter:

Opponents of payday loans say the loans’ high cost — typically $15 per every $100 borrowed (small loans, $500 or less) over two weeks — takes advantage of poor people in need. Projected beyond two weeks to a full year, the cost amounts to about a 400 percent annual percentage rate (APR). The loans often cause borrowers to need to take out successive loans till they can finally pay them off, they say. Payday lenders make people in need worse off and profit from them.

Except that removing that option is what is leaving consumers worse off. Researchers at the Federal Reserve Bank of New York studying the end of payday lending in Georgia and North Carolina found that people in those states “bounced more checks, complained more about lenders and debt collectors, and have filed for Chapter 7 (‘no asset’) bankruptcy at a higher rate” than they would have if the lenders were still legal. The increase in bounced checks especially cost consumers millions of dollars per year.

“Forcing households to replace costly credit with even costlier credit,” they wrote, “is bound to make them worse off.”

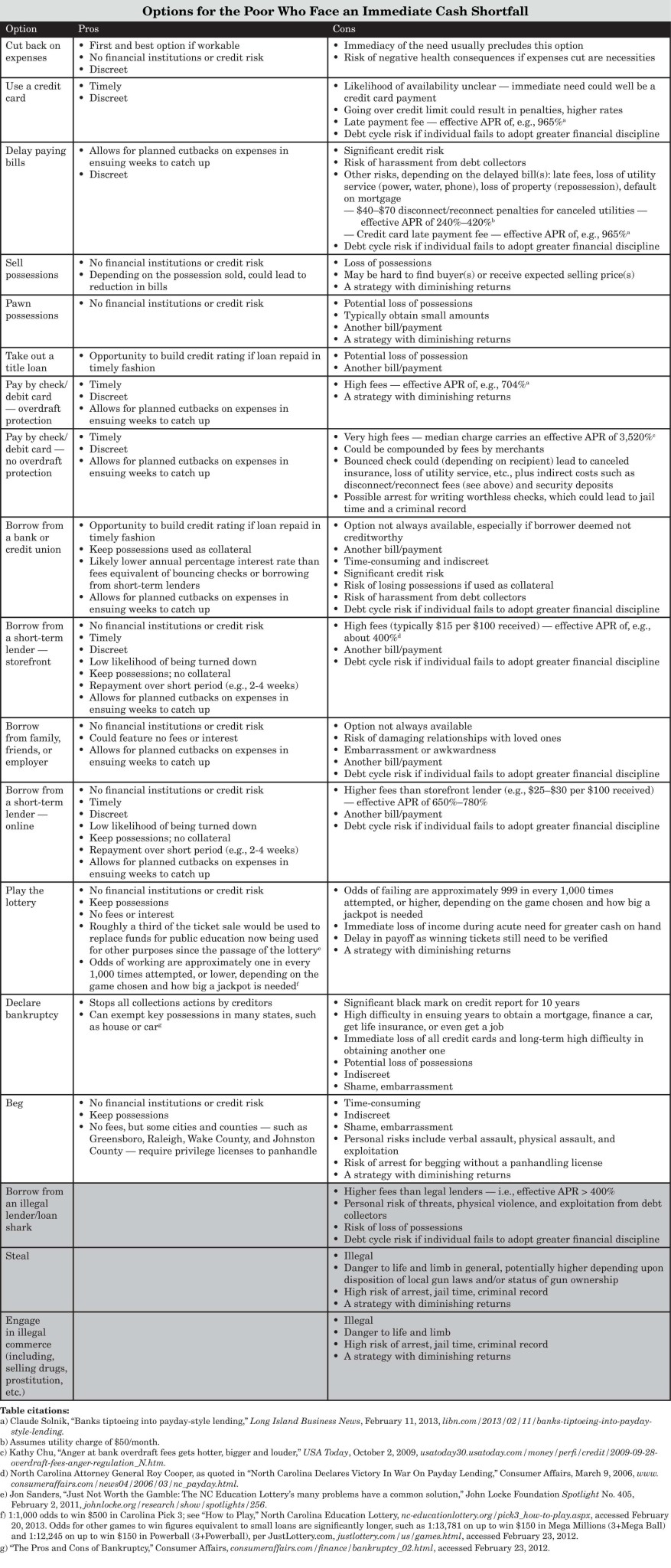

Here is how that 400 percent “effective APR” compares with the effective APRs of their other options:

Absent payday loans, other options carry fees that equate with high effective APRs: bounced-check fees (3,520 percent without overdraft protection and 704 percent with); utility disconnect or reconnect fees (240-420 percent); credit card late payments (965 percent); and borrowing from an online payday lender (650-780 percent) or loan shark (indeterminate)

Following this (click more) is a table from that report; you’ll need to click the image or go to the report for the full, more legible size: